Market Overview: S&P 500 Emini Futures

S&P 500 Emini futures April candlestick consecutive bull bars close above the 20-month exponential moving average (EMA). Monday is the first trading day of the month. The market may gap up at the open, creating a gap on the Monthly, Weekly and Daily charts. Small gaps usually close early. The bears hope the market will stall sideways around the 20-month exponential moving average and reverse lower.

S&P500 Emini futures

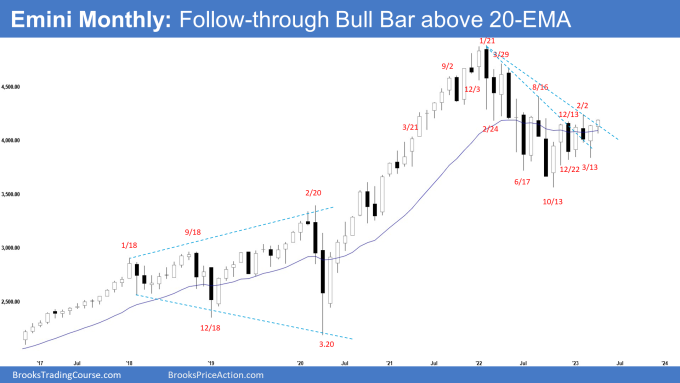

The Monthly Emini chart

- The April monthly Emini candlestick was a small bull bar closing near its high.

- Last month, we said odds slightly favor sideways to up in early April and traders will see if the bulls can create a follow-through bull bar in April. Or will the Emini trade slightly higher but close with a bear body or a long tail above.

- The market was mostly trading sideways throughout the month, and the bulls got a strong 2-day reversal from the low of the month to close near its high in the last 2 trading days. There are potentially trapped bears.

- The bulls managed to create consecutive bull bars closing above the 20-month exponential moving average in April.

- Looking back, whenever this has happened (consecutive bull bars closing above the 20-month exponential moving average), it has increase probability of leading to at least slightly higher prices.

- The bulls want another strong leg up from a double bottom bull flag (Dec 22 and Mar 13), completing the wedge pattern with the first 2 legs being December 13 and February 2 highs.

- The next targets for the bulls are the February 2 high and the August 2022 high.

- They will need to create a strong breakout above the February 2 high with follow-through buying to convince traders that the bull trend could be resuming.

- The bears see the move down from January 2022 as a broad bear channel, with the August 2022 high as the last major lower high.

- If the Emini trades higher, they want a reversal down from a small double top with the February high or a larger double top bear flag with the August 2022 high.

- The problem with the bear’s case is that they have not been able to create sustained follow-through selling since September 2022.

- The bears hope the market will stall sideways around the 20-month exponential moving average and reverse lower.

- Since April’s candlestick is a bull bar closing near its high, odds favor May to trade at least a little higher.

- Monday is the first trading day of the month. The market may gap up at the open, creating a gap on the Monthly, Weekly and Daily charts. Small gaps usually close early.

- The candlesticks in the last 12 months are overlapping sideways which means the Emini likely has transitioned into a trading range phase between 4300 and 3500.

- The last 6 candlesticks are overlapping in a smaller tight trading range between 4200 and 3750.

- Poor follow-through and reversals are more likely within a trading range.

- Traders will BLSH (Buy Low, Sell High) until there is a breakout from either direction with follow-through buying/selling.

- Until the bulls can break far above the August 2022 high, the broad bear channel may still be in play.

- For now, May should trade at least a little higher in early May.

- Traders will see if the bulls can create another follow-through bull bar or will the Emini trade higher but close with a bear body or a long tail above.

- If May is a big bull bar closing near its high, it could potentially flip the market to Always In Long.

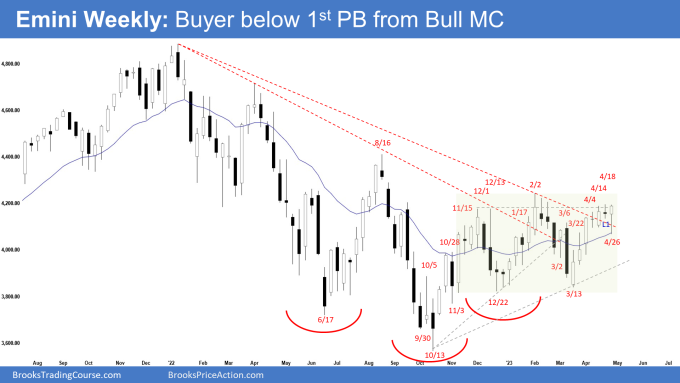

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was a bull bar closing near its high with a long tail below.

- Last week, we said that traders will see if the bears can create follow-through selling or will the market trade slightly lower but find buyers instead.

- This week traded below the lows of the last 3 candlestick’s, testing the 20-week exponential moving average but reversed to close near the week’s high.

- The move up from March 13 low is in a tight bull channel. That means strong bulls.

- The bulls want another strong leg up completing the wedge pattern with the first two legs being December 13 and February 2. The third leg up is currently underway.

- The next targets for the bulls are the February 2 high and the August 2022 high.

- They had a 6-bar bull micro channel and there are often buyers below the first pullback from such a strong bull micro channel. This was the case this week.

- If there is a deeper pullback, the bulls want a larger second leg sideways to up to retest the current leg extreme.

- The bears hope that the current leg up is simply a buy vacuum retest of the February 2 high.

- They want a reversal down from a lower high major trend reversal or a double top with February 2 high and a larger wedge pattern (Dec 13, Feb 2, and April 18).

- If the Emini trades higher, they want a failed breakout above the trading range high (February 2)

- The problem with the bear’s case is that they have not been able to create credible selling pressure since the March low.

- They will need to create strong bear bars with follow-through selling to convince traders that a deeper pullback could be underway.

- At the very least, the bears will need a strong sell signal bar or a micro double top before they would be willing to sell more aggressively.

- Since this week was a bull bar closing near its high, it is a good buy signal bar for next week.

- However, the Emini is trading near the top of the 27-week trading range. Buying at the top of a trading range can be risky.

- The Emini may gap up on Monday. Small gaps usually close early. If the gap remains open by the end of the week, it could be a sign of strength from the bulls.

- Traders will see if the bulls can create a retest and breakout above the February high with follow-through buying or will the market continue to stall around the February 2 high area.

- For now, the odds slightly the Emini to trade at least a little higher.

Trading room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Hello Andrew. Monthly chart looks like price is high in a TTR or TR. Likely sellers above bulls.

*Likely sellers above bars

Dear Leonardo,

What you say is true..

However, because of the strong move up, the bears will need a decent sell signal bar to sell such a strong leg up – and there is none yet..

Let’s see how the market play out over the next several weeks..

Thanks for going through the report Leonardo..

Have a blessed week ahead..

Best Regards,

Andrew

Andrew hey,

Thanks for the report. April range is extremely narrow vs the entire structure from the left. What should be the PA interpretation for that?

Dear Eli,

A good day to you.. A good question..

I’m not sure I have a definitive answer to that.. but here are my thoughts..

I would attribute it to bulls and bears fighting for control at a resistance area (trading range high) and both have about equal odds. Which led to the small range.

While small, it was still a follow-through bull bar on the Monthly chart..

Let’s see how the market play out next week..

Have a blessed week ahead Eli..

Best Regards,

Andrew