Market Overview: S&P 500 Emini Futures

The S&P 500 Emini futures traded above last week’s high but reversed to close below last week’s low, closing as an Emini big bear outside bar. There is now an OO (outside-outside pattern). The Emini is in breakout mode. The bar sometimes after an outside bar is an inside bar, forming an ioi (inside, outside, inside) pattern, which is also a breakout mode. Traders will be monitoring whether the bears get a consecutive bear bar or fail to do so. If the bears get it, the odds of a test of the June low increase.

S&P500 Emini futures

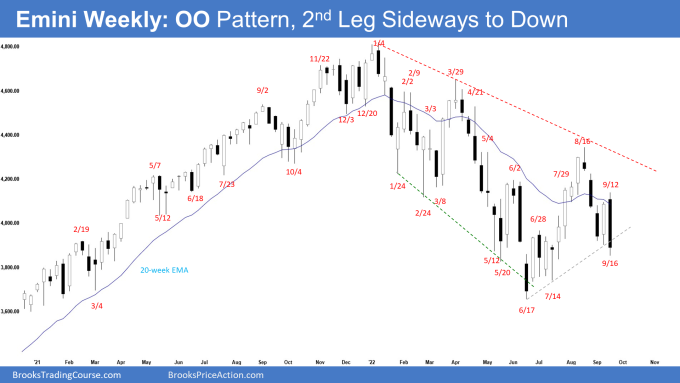

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was an outside bear bar with a noticeable tail below.

- Last week, we said that odds slightly favor sideways to up and traders will be monitoring whether the bulls get a consecutive bull bar or fail to do so.

- If the bulls get a consecutive bull bar, the odds of a test of the bear trend line and Aug 16 high increases. However, if next week closes as a bear bar, we may start to see sellers return for the second leg sideways to down.

- This week traded above last week’s high but reversed to close below last week’s low.

- The bears got a reversal lower from above the 20-week exponential moving average. They want a retest of the June low.

- They want a strong leg down like the one in April. The bears will need to create consecutive bear bars closing near their lows, to increase the odds of a retest of the June low.

- The selloff from August was strong with consecutive bear bars closing near their lows with an open gap and a micro gap. That means strong bears.

- The bears want at least a small second leg sideways to down, testing Sept 6 low. They got it this week.

- The move up from June 17 low was in a tight channel. The bulls want a second leg sideways to up after a pullback. At the very least, they want a retest of Aug 16 high.

- They want a reversal higher from a higher low major trend reversal.

- We said that the problem with the bull’s case was that the recent selloff was very strong. The second leg sideways to up may only lead to a lower high. This week was a lower high.

- The 20-week exponential moving average and major bear trendline are resistances above.

- Bulls had to create a follow-through bull bar closing far above the 20-week exponential moving average to increase the odds of a retest of the Aug 16 high. They failed to get that this week.

- Since this week was a big bear bar closing near the low, it is a sell signal bar for next week.

- There is now an OO (outside-outside pattern). The Emini is in breakout mode. The bar sometimes after an outside bar is an inside bar, forming an ioi (inside, outside, inside) pattern, which is also a breakout mode.

- For now, odds slightly favor sideways to down. Traders will be monitoring whether the bears get a consecutive bear bar or fail to do so.

- If the bears get a consecutive bear bar, the odds of a test of the June low increase. However, if next week closes as a strong bull bar instead, we may have another attempt to retest the 20-week exponential moving average.

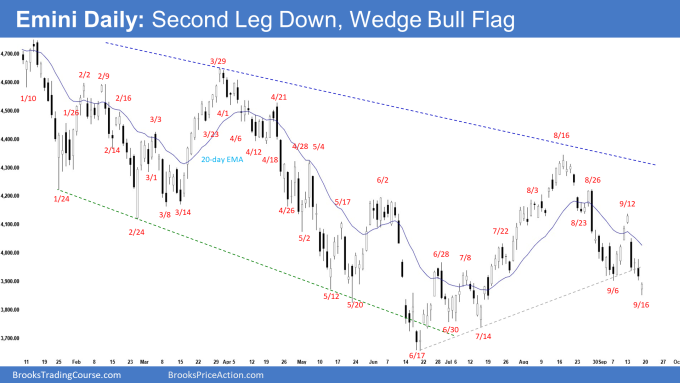

The Daily S&P 500 Emini chart

- The Emini gapped up and closed higher on Monday. Tuesday gapped down and closed far below the 20-day exponential moving average, and sold off for the rest of the week. Friday gapped down below Sept 6 low but reversed to close as a small bull reversal bar near the high.

- Last week, we said that odds slightly favor sideways to up, but if the bulls fail to create consecutive bull bars above the 20-day exponential moving average early next week, we may see sellers return for the second leg sideways to down to retest the Sept 6 low.

- The move up from June 17 low was in a tight channel. That increases the odds that the bulls will get at least a small second leg sideways to up, to retest August 16 high.

- So far, they have only managed to create a lower high.

- The bulls want a continuation higher from a higher low major trend reversal and a wedge bull flag (Aug 23, Sept 6 and Sept 16) after the current pullback.

- The bulls will need to create consecutive bull bars closing near their highs to convince traders that a re-test of the Sept 12 high or the August 26 high is underway.

- The problem with the bull’s case is that the recent selloff from August 16 was very strong. The larger second leg sideways to up may only lead to a lower high.

- The bears want a retest of the June low, followed by a breakout, and a measured move down.

- The selloff from Aug 16 was strong enough for traders to expect at least a small second leg sideways to down. They got it this week.

- If the Emini trades higher, the bears want a reversal lower from a double top bear flag with the Sept 12 high. They want the Emini to fail around the 20-day exponential moving average again.

- Since Friday was a bull bar closing near the high, it is a weak sell signal bar for Monday. Monday may gap up at the open. Small gaps usually close early.

- While the sell-off is strong enough for traders to expect at least slightly lower prices, traders should be prepared for some sideways to up pullback lasting days in between which can begin at any moment.

Trading room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. Al talks about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

On the RTH chart, the profit from below last week’s low to the June low is 214 points while the stop is 185 points. Do you think the probability is high enough to create a good trader’s equation?

Hey Andrew, a good day to you..

The probability will be highest in a new breakout / spike.. higher probability, but the traders equation may lower. Currently, I don’t feel like the market is in such a spike phase.

Selling below last week’s low may work, but requires a big stop and a smaller position..

At the moment with a wedge bull flag, if I wanted to swing a new short on the daily chart, I would prefer to wait for a bounce, and see if price stalls near the 20ema or the double top bear flag with Sept 12 for a better entry.

What are your thoughts?

Have a blessed week ahead.

Best Regards,

Andrew

Although the shape is not great, last week was the third push down from the August high. I agree I’d be less eager to sell down here and wait for two legs up with a good bear signal bar.

That would be safest.. let’s see how the market plays out..

Have a great week ahead!

Best Regards,

AA