Market Overview: DAX 40 Futures

DAX futures was a bull bar at a prior breakout point. It’s always in short on the monthly chart and weekly but with consecutive bull bars at prior breakout points on the weekly we might go sideways. It is a low probability buy for the bulls and it’s selling low in a developing trading range for the bears. The bulls want a follow-through bull bar next month for a chance at trend resumption.

DAX 40 Futures

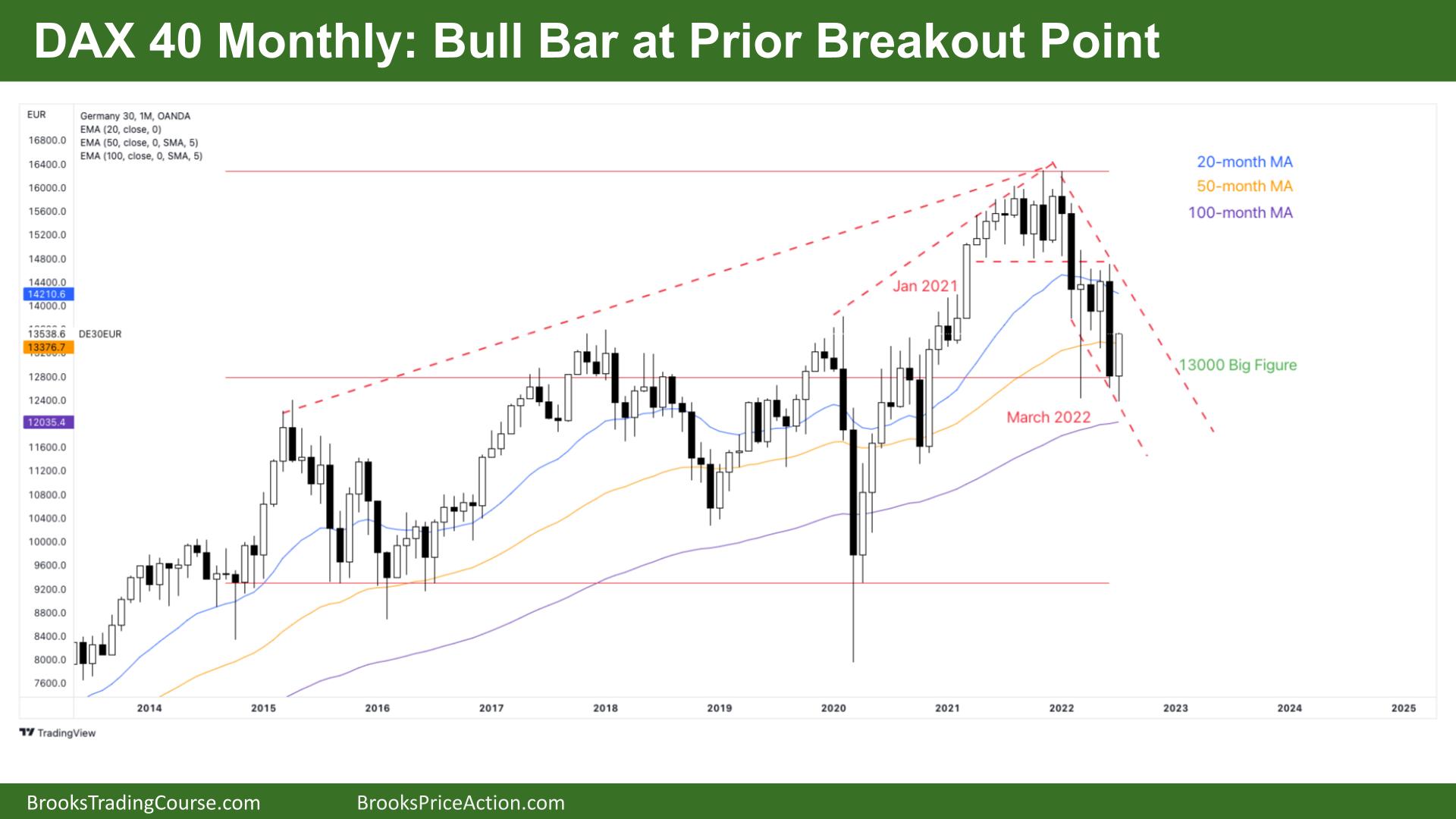

The Monthly DAX chart

- The Dax 40 futures was a test of a prior breakout point, a bull bar closing on its high so we might gap up on Monday.

- For the bulls, it is a two-legged pullback in a bull channel. It’s a micro double bottom (Micro DB) from a prior breakout point at the start of last year. They see a sell climax and a strong reversal back up.

- The bulls want a consecutive bull bar closing on its high. If the bulls can get consecutive bull bars we might get back above the moving average. But all the biggest bars recently are bear bars so that might only be 40% chance right now.

- For the bears it’s a 50% pullback in a 7-bar tight bear channel. It is the 3rd bar to close below the moving average in 18 months so it’s not as bearish as it seems.

- After June’s bear breakout bar, traders might expect a second leg sideways to down.

- If you look at a chart and you’re confused, it is likely in a trading range and traders will trade it as such.

- Bulls are buying below bars and not above. Bears are selling above bars and not below.

- It’s a High 1 buy above July but can expect sellers as well who are looking for a move down. Buyers might have more luck with a higher low double bottom over the next few months.

- We are at the midpoint of all the trading for the past 7 years, the 13000 big round number so we might go sideways around here until traders decide.

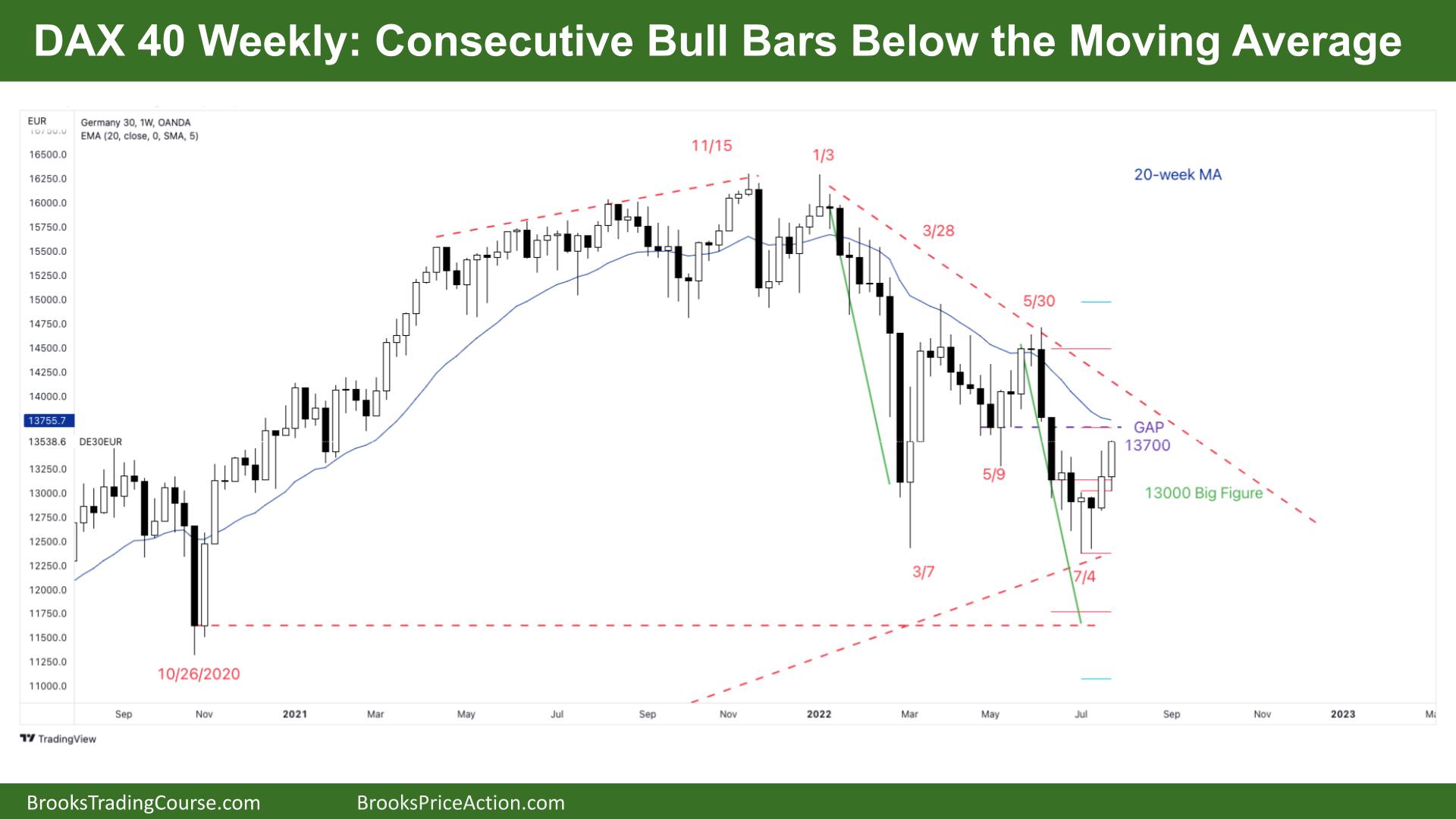

The Weekly DAX chart

- The Dax 40 futures was a bull bar closing on its high so we might gap up on Monday.

- The bulls see consecutive bull bars, both closing above their midpoints, and one large closing on its high so some traders will see that as always in long.

- If you’re trading always in you bought back shorts above last week’s bull bar and are looking to get in again. It’s sideways so next week’s bar will be important.

- The context is challenging – two massive consecutive bear bars in June, only two weekly bars all year above the weekly moving average? Most traders should wait on this timeframe.

- It was not a strong buy signal last week so we can expect to come back here. This week is a better buy signal but under the moving average is high in a trading range and traders want to buy low.

- The bears see a bull trap and will look to sell above and near the moving average. They want to sell a Low 1 or Low 2.

- Some traders are still on the moving average gap bar sell.

- It’s a lower low in a bear trend so bears will sell above bars and at lower highs where bulls will exit and there is gap below May 9th which we might need to go above before another leg down.

- The bulls want a strong follow-through bar, a give-up bar from the bears but both might get disappointed. Maybe a follow-through bar with big tail above closing the gap, or a small bear bar to keep traders guessing.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.