Market Overview: DAX 40 Futures

DAX 40 outside down bar at 13000 big round figure. The bulls failed to break out of the trend line and the inside-outside down pattern was sold off. It is a micro double bottom with March and looks bearish, but we are at prior support for the bulls. If the bulls can pause here and setup a High 1 or High 2 we might get a chance to test the highs later this year. You can see we are at the 50% mark of the pandemic lowest close and the bull runs highest close, so the measured move had finished for the bulls.

DAX 40 Futures

The Monthly DAX chart

- The DAX 40 futures was a bear surprise bar, an outside down bar at 13000 big round number. It has a small tail below it.

- It is a micro double bottom with March and a pause at the pre-pandemic high.

- The bulls see a micro double bottom and a pullback to the prior breakout point after the pandemic’s initial lows. They see we are at the bottom of a bear channel and expect bears to take profit here, expecting a reversal. They will likely scale in lower.

- Bulls see last month as a sell climax as the biggest bear bar in the recent trend.

- The bulls want a pause bar, an inside bar with a tail below for a micro double bottom and setup a High 1 buy on the monthly chart.

- Bulls look left and see that the 5 previous times we crossed the 50-month MA, the bears exited so they will likely buy here again.

- But is the context different?

- The bears see a broad bear channel and a surprise bar late in the trend and might expect a measured move down from here.

- The bears know we are likely always in short and want a follow-through bar. But there is something wrong with the trend. 2 bear bars, pause, bear bar pause – it is not big consecutive bear bars which tells us it is likely a leg in a trading range.

- So if we are in a trading range where is the bottom? Perhaps we are at it. They know that the month following a push down to the 50-month moving average was reversed each time, so they are likely to scalp.

- Reasonable to expect prices to go sideways to down here.

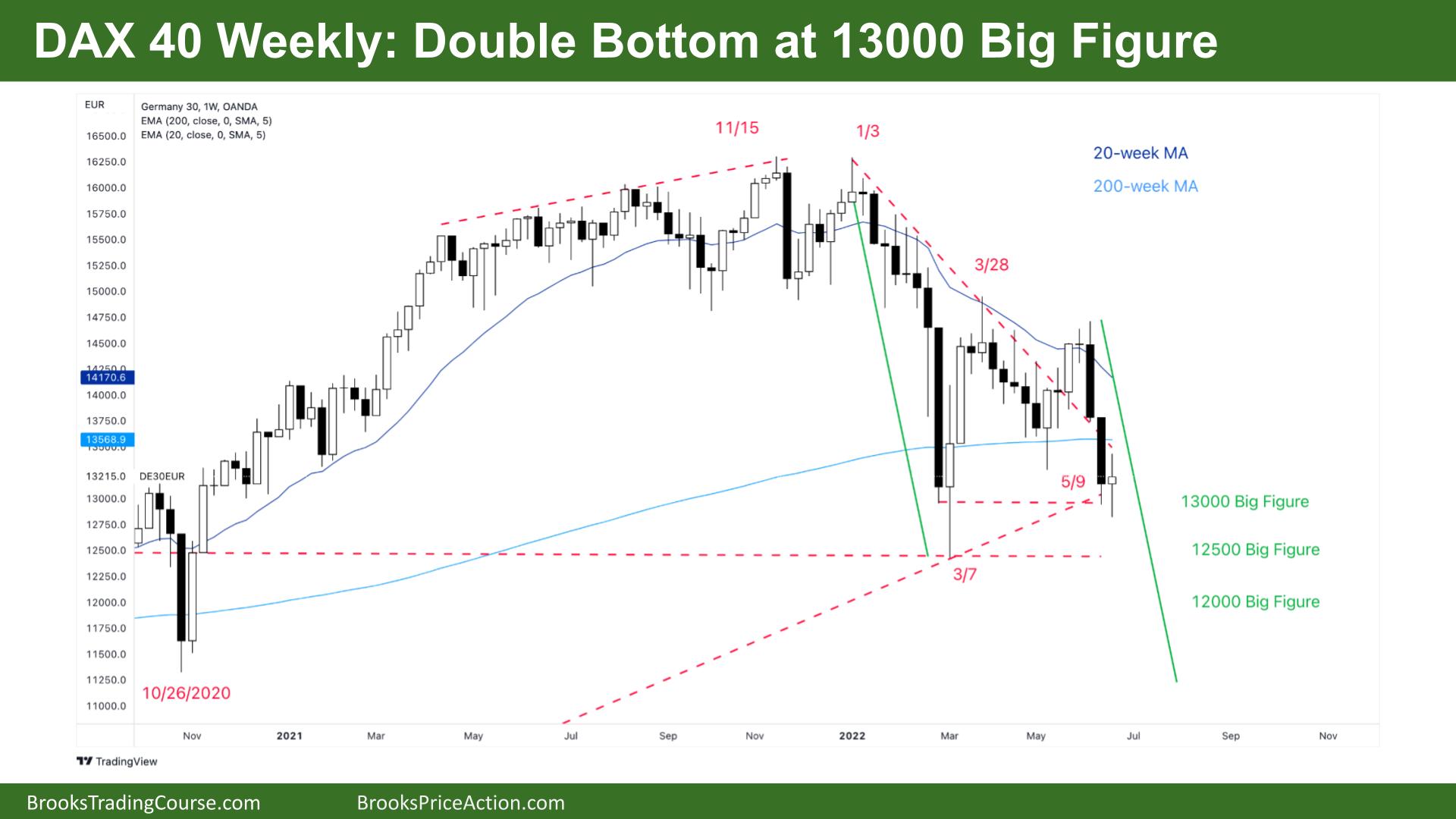

The Weekly DAX chart

- The Dax 40 futures was a small bull doji at the 13000 big figure. It is a micro double bottom with last week and a potential double bottom with March 7th.

- The bulls see a higher close than March and it could be a higher low major trend reversal. They know we failed to get a reversal last month and this second time might work.

- They see the consecutive bear bars as a sell climax and the bottom of a trading range, so the math favors buying here. They want a follow-through buy signal like a High 1 or High 2 for a test up to the top of May.

- They also see a possible wedge bottom and might scale in lower on an overshoot reversal swing.

- Bears see a broad bear channel from January and now we are forming a trading range. They see the lower high major trend reversal in January and expected 2 legs down and we are in the second leg.

- The bears would like to get a harmonic retracement on the green line of the same distance but that might be too far.

- They see the failed breakout by the bulls, a bull trap and collapse from the breakout point as a sign to keep selling above prior bars. The bears might expect a measured move from the consecutive bear bars last few weeks which would bring us new lows for the year.

- It is reasonable to expect sideways to down-trading from here.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.