Market Overview: DAX 40 Futures

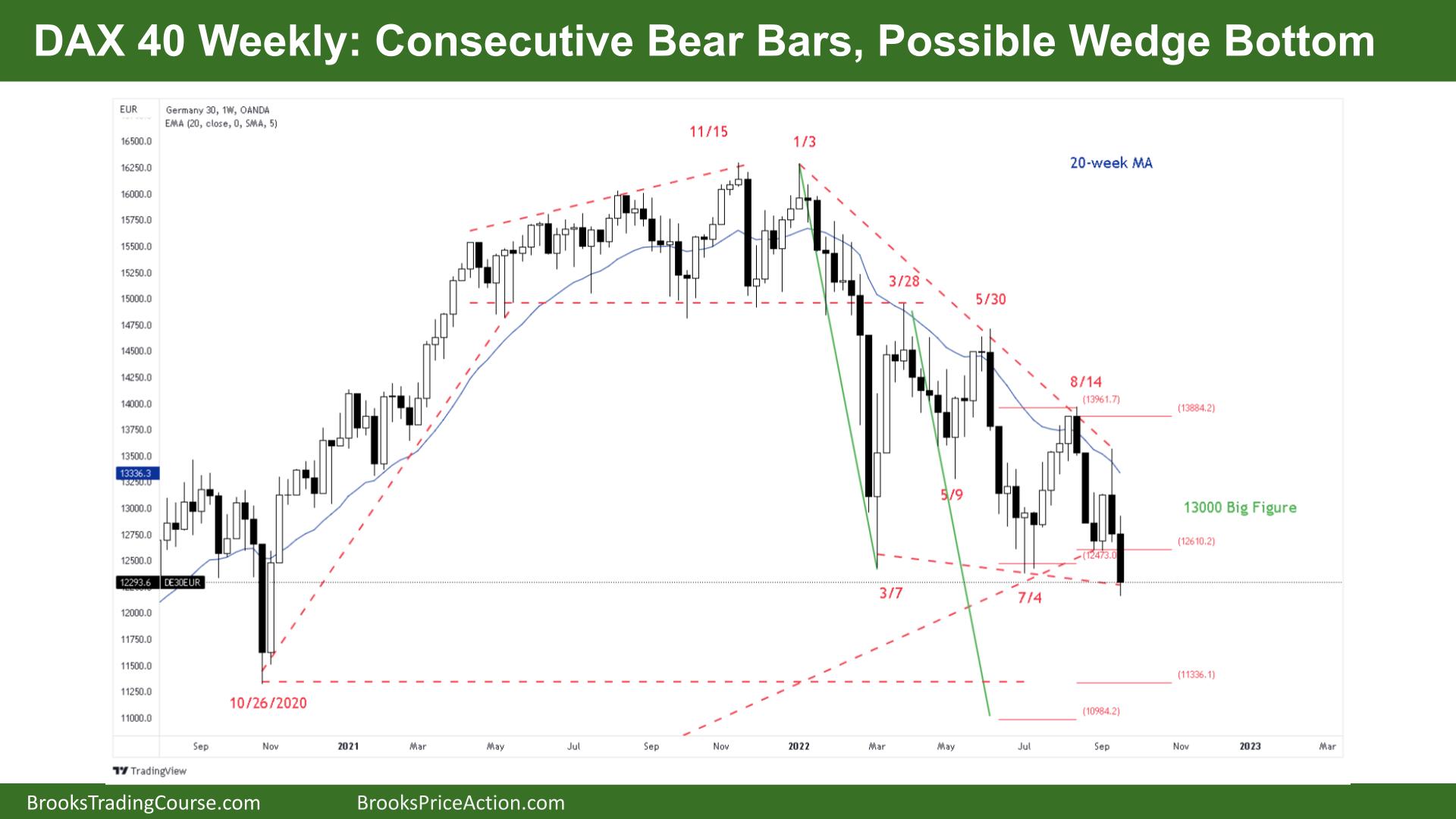

DAX futures moved down again last week with DAX 40 consecutive bear bars and setting up a possible wedge bottom. The bears got a break below the March lows, but we have been going sideways for many weeks, it might form a tighter trading range here. Bears want a follow-through bear bar closing below this week confirming the breakout, and bulls will buy below this week betting on more sideways to down. The bulls got 4 weeks of continuous buying in July and August so it’s not as bearish as it could be.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures was a bear bar closing near its low so we might gap down on Monday.

- It is also the second consecutive big bear bar closing on or near its low, so traders might expect a second leg down.

- For the bulls it’s a lower low and a possible wedge bottom – they will look for a reasonable buy signal to buy for 2 legs sideways to up.

- But it’s a bear bar so a sell signal and with two measured move targets below and a harmonic we have been expecting for months.

- The bears see we are always in short, 2 legs and consecutive bear bars they can sell on close and sell pullbacks for a possible third leg down.

- We have been sideways for 6 months, so limit order bulls have been making money and will likely buy again new lows expecting a retracement above prior lows.

- No gaps on the weekly mean it’s a trending trading range and not a strong bear trend. This could change if the bears get a strong breakout below the wedge and start a measured move down.

- Better to be short or flat. Because 3 weeks ago was a reasonable buy signal, the next weekly bull bar will attract more buyers and we will likely go 50% back to that bar or up to its entry point.

The Daily DAX chart

- The DAX 40 futures was a bear bar closing below its midpoint on Friday so we might gap down on Monday.

- It is a 9-bar tight bear channel so most traders should only be looking to sell.

- The target was the March lows and we closed just below it at a harmonic move down from the chart.

- The bulls see 2 legs down after a strong bull channel and see a lower low major trend reversal. They see Friday as a sell climax and sell vacuum test of the lows.

- Limit bulls have been buying below bars for months and making money so will continue to do so as 80% of breakouts fail and a trading range is more likely.

- The bulls want a reasonable High 1 buy signal to get long, currently, there is only sell signals.

- The bears see a second leg down and a tight bear channel. They expect the first reversal to be minor and might get the third leg down.

- They want the third leg to be reasonably past the March lows so as not to set up a wedge bottom buy signal.

- It’s a bear breakout bar and a lower low but they need follow-through to convince traders of a measured move down. There is a weekly target below.

- The bulls know there are no gaps so it is more like a trending trading range, not a bear trend. That means limit-order traders are making money and it is not a strong trend.

- If the bears can get a breakout and a pullback that does not go above the recent lows, that would create a gap for a measured move.

- With consecutive bear bars on the weekly chart expect more sideways to down next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Many thanks for your analysis Timothy which help me a lot. Since Im daytrading the DAX I am using the intraday chart but I noticed that you are using the GLOBEX one. Are there advantages to GLOBEX for DAX as Intrday’s 2 final hours include the US session (for daily and weekly charting)? Thanks!

Hi. What is the difference between DAX Globex and intraday chart? Trading Hours? Maybe you know if there is possibility to trade futures on regular DAX index hours?

Thanks Mindaugus for your comment – the main trading hours for the DAX 40 index are between 09:00 and 17:30 CET, though Deutsche Börse also calculates the early DAX (08:00 – 09:00 CET) and late DAX (17:30 – 22:00 CET) for trading out-of-hours.

The DAX Globex is traded 24 hours so across timeszones.

Thanks for answer Timothy. As I know Emini can trade on Globex and on daily hours. So i am curious is there possibility to trade DAX futures in chart where trading between 9:00 and 17:30 CET ? (like DAX index) Or do I need to use other instrument if want to trade DAX only in these hours.

Hi Profezy – thanks for your comment – yes I look at both when day trading but I find the GLOBEX ranges good targets for swing entries on higher time frames – they can also help see how strong a trend is – ie a huge retracement on the GLOBEX and none on the INDEX can help me to avoid giving back profits the next day – does that help? Tim

Great info and yes it helps alot! Thanks