Market Overview: DAX 40 Futures

DAX futures moved higher in a bull breakout last week. Consecutive bull bars at a new ATH, so most traders should be long or flat. We are starting to get a lot of sideways price action, so it is a channel, and many bulls will scale-in lower and scale-out at the new highs. We are at one measured move for the bulls now and have more above. There are a lot of doji bars, so traders should be careful of buying too high.

DAX 40 Futures

The Weekly DAX chart

- The DAX 40 futures moved higher with a strong bull bar closing on its high in a breakout.

- Bulls now have consecutive bars closing on their highs and above the MA, so always in long. Traders should expect sideways to up next week.

- The bulls see a breakout above a TR and expect a move up. They see a bull spike and channel, and traders will buy and scale in lower.

- Bears see a broader channel, with deep pullbacks, and are selling highs and scaling in higher. Most traders should not do this when the chart is sloping up.

- Bears tried to get a second entry sell, an attempt at a double top last week, but a lack of follow-through from the stop entry bears ended it.

- They were able to trigger a few bear bars by going below them. But once lower tails appear right above the MA, that is usually a sign of limit order trading and not strong reversal setups.

- After 6 consecutive bull bars in October, traders expected a second leg, and they are getting it. This leg should be sideways.

- The bulls want another strong close above the prior high for another open gap. Then they can defend a strong pullback.

- The bears want a reversal bar for a failed breakout above the ATH this week. This is a low-probability event right now. So if it sets up, it could go far.

- No sell signal for the bears, so traders are either long or flat.

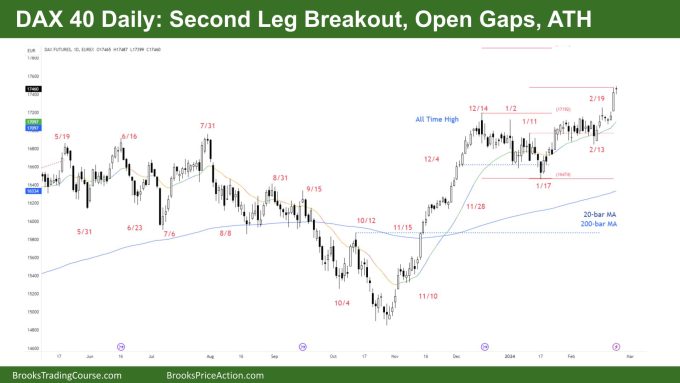

The Daily DAX chart

- The DAX 40 futures moved a new ATH on Friday again after a bull breakout on Thursday.

- Thursday was a large bar, so the follow-through is important.

- Bears needed a bear bar, a lower close than Thursday, but because of the gap up they didn’t get it.

- Bulls see a spike and channel on the HTF.

- In this second part of the move-up, they now have two legs. They probably need one more.

- The bulls have measured move targets above, but we will likely go sideways to up.

- The bears see a channel but see profit-taking at new highs and limit order bears making money. Most traders should not be selling new highs at the ATH.

- Many dojis on this timeframe, so we might form a parabolic wedge in either direction. This bull channel has a 75% chance of turning into a bear leg in a trading range.

- Bulls are buying above weak dojis, a sign of strong bulls.

- Bears probably got stuck last week, the bear doji was not a good sell signal, so most limit order bears would wait to sell higher.

- Bears need a failed breakout or a climactic move to go sideways and set up a second entry sell.

- It could be a small pullback bull trend. In hindsight, many of the recent bear bars were buy setups.

- Always in long, so better to be long or flat.

- Expect sideways to up next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.