Market Overview: DAX 40 Futures

DAX 40 bear reversal at the moving average. It’s a tight bull channel with 4 consecutive bull bars so it’s not a high probability sell below, but bears have been selling the moving average and making money. We are also at a measured move target on the weekly, although short of two targets on the daily so we might get another leg up before reversing.

DAX 40 Futures

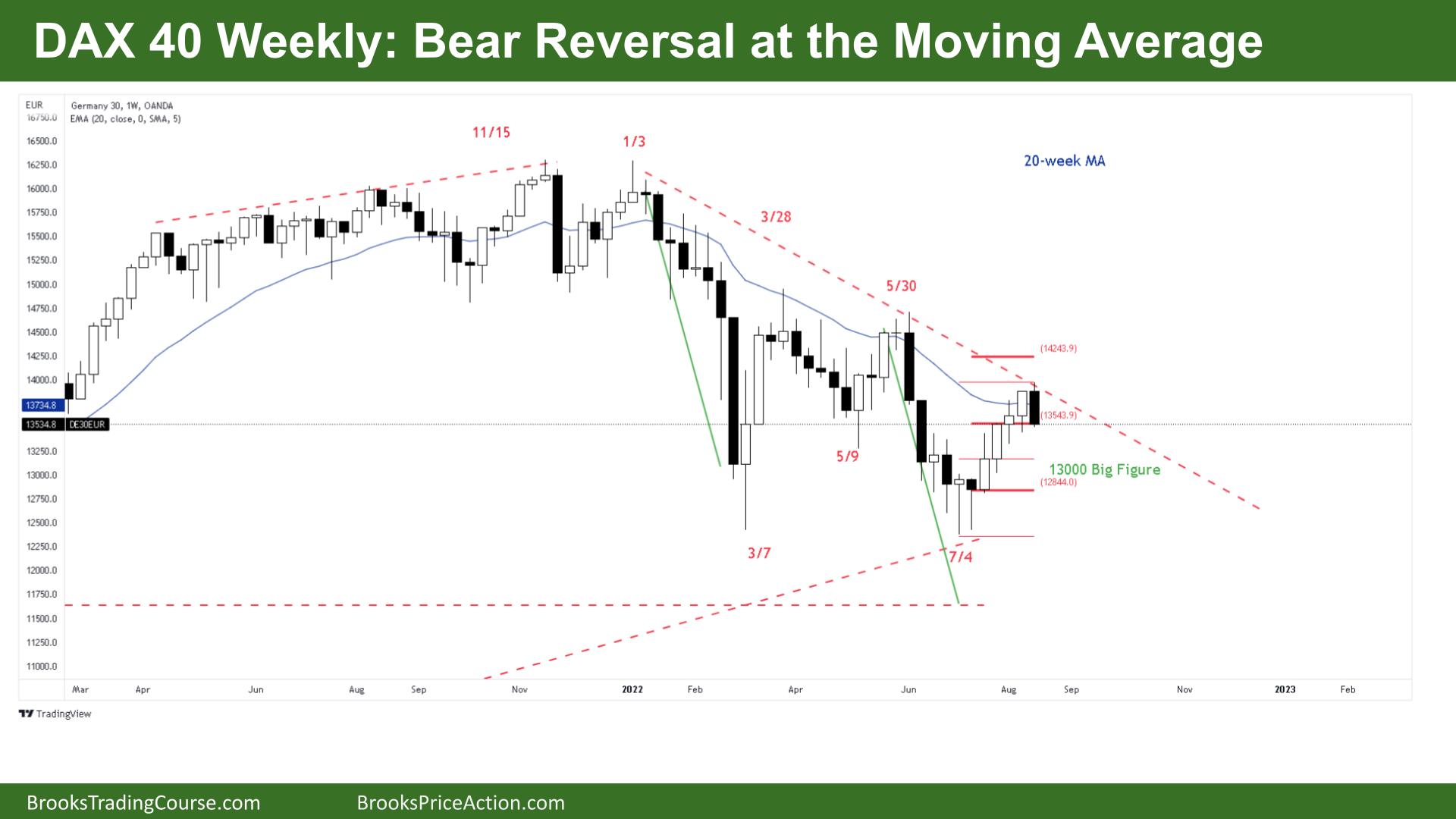

The Weekly DAX chart

- The DAX 40 futures on the weekly chart was a big bear bar closing near its low so we might gap down on Monday.

- It’s a bear reversal at the moving average, but it didn’t go below a prior bar so it’s not yet as bearish as it could be.

- For the bulls, it’s a 7-bar bull micro channel – a channel without a pullback. So it’s also a spike and could lead to a channel up.

- The bulls see a double bottom with March and April, and want a breakout above the May high for a measured-move back up to January.

- The bears see a broad bear channel and we’re selling off each time we touch the 20-week moving average (MA), so they expected to sell here last week.

- Next week, if we trade below this week, would be a Low 1 sell signal in a bear trend and at the moving average. Although it’s a tight bull channel, so a higher probability short would be a Low 2 at the moving average.

- For the bulls, it’s a pullback and they will look to buy below at the Low 1 for a second leg up. We just touched one of the measured move targets so we might pull back here.

- There is another measured move target above, which would be reasonable, allowing the second leg after such a strong bull move.

- We’re in a trading range so there are reasonable cases for buying and selling and generally if traders look to scale in and trade small, they can use trade management to make money.

- It’s a decent sell signal for the bears and we might trade below next week. If the bears can get a follow-through bar – consecutive big bear bars closing on their lows, then it would be back to always in short.

- If the bulls can buy below and get a High 1 or outside up bar, then that increases the chance of going up to the top of the March range.

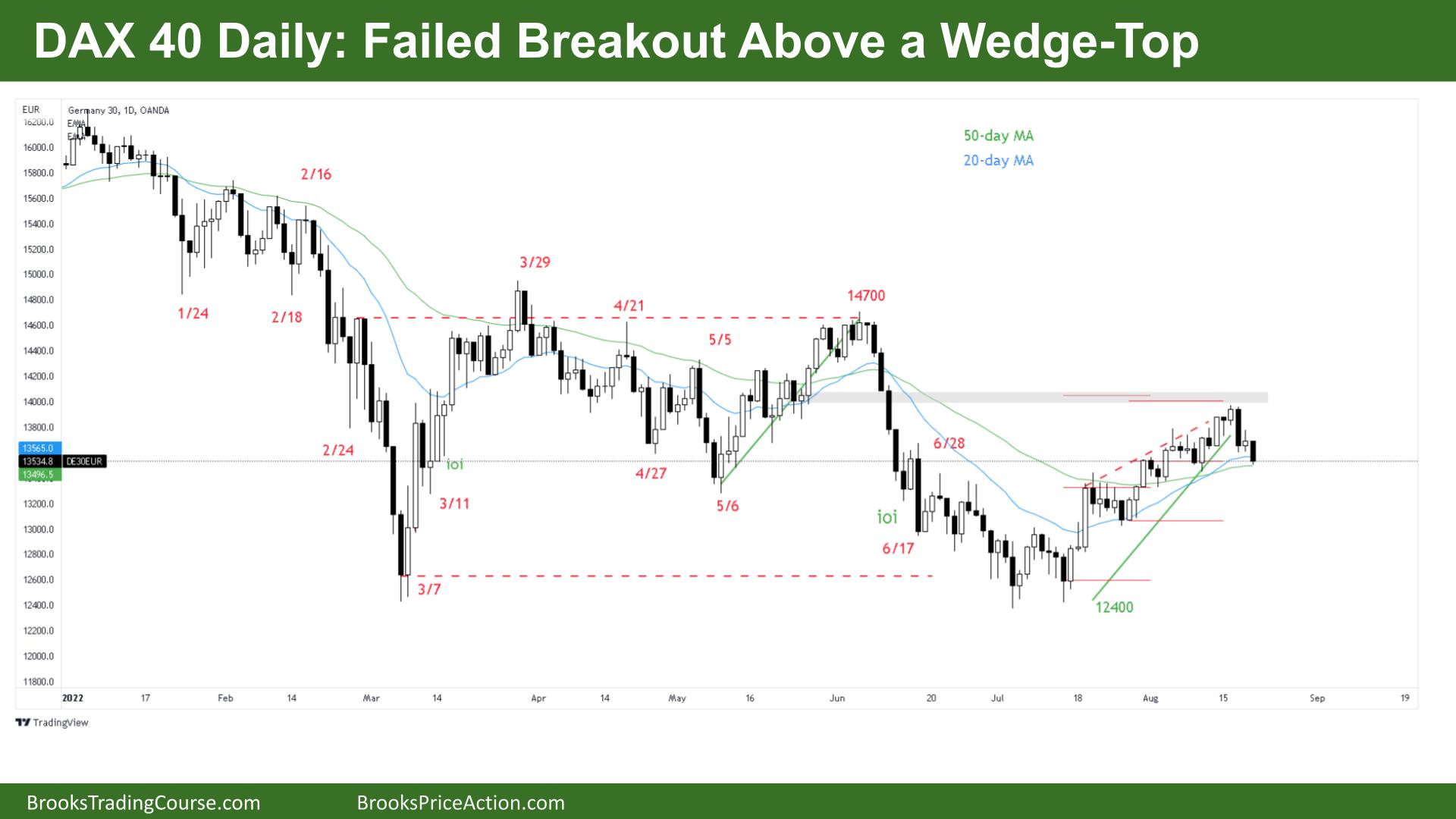

The Daily DAX chart

- The DAX 40 futures on the daily chart was a bear bar closing on its low so we might gap down on Monday.

- For the bulls, it’s a two-legged pullback in a small pullback bull trend. Bulls will look to buy a High 1 or High 2 near the moving average.

- For the bears, it’s a failed breakout above a wedge top. They are expecting two legs sideways to down.

- If you’re confused, you are probably in a trading range. We are right in the middle of the past 6 months of trading so the probability is 50% at best.

- The bulls hit a measured move target on the weekly chart but missed both measured move targets on the daily chart. We might need to get back there before traders decide to move down.

- Although it’s a bear reversal, the bear bars are neither consecutive nor big, so it is not as bearish as they could be.

- The bears want a follow-through bar and a good close on Tuesday, for a chance at a stronger leg down.

- Bulls want a reversal bar around the moving average to make the bears give up and look to get to their targets above. There is a chance both sides will be disappointed.

- Bears could get a surprise bar with no follow-through, forcing them to sell too low. Bulls might get consecutive bull dojis, making it tough to buy. Expect sideways next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.