Market Overview: DAX 40 Futures

DAX futures had bad follow-through from bull breakout last week — a tiny bear doji. The trend has been strong since October, and we might be in the final flag before the last leg. The bears want to trap the bulls high and reverse back to the moving average. But they really needed a close below the MA. If there is no follow-through selling under the doji, then expect another leg up to the All-Time High and top of the trading range.

DAX 40 Futures

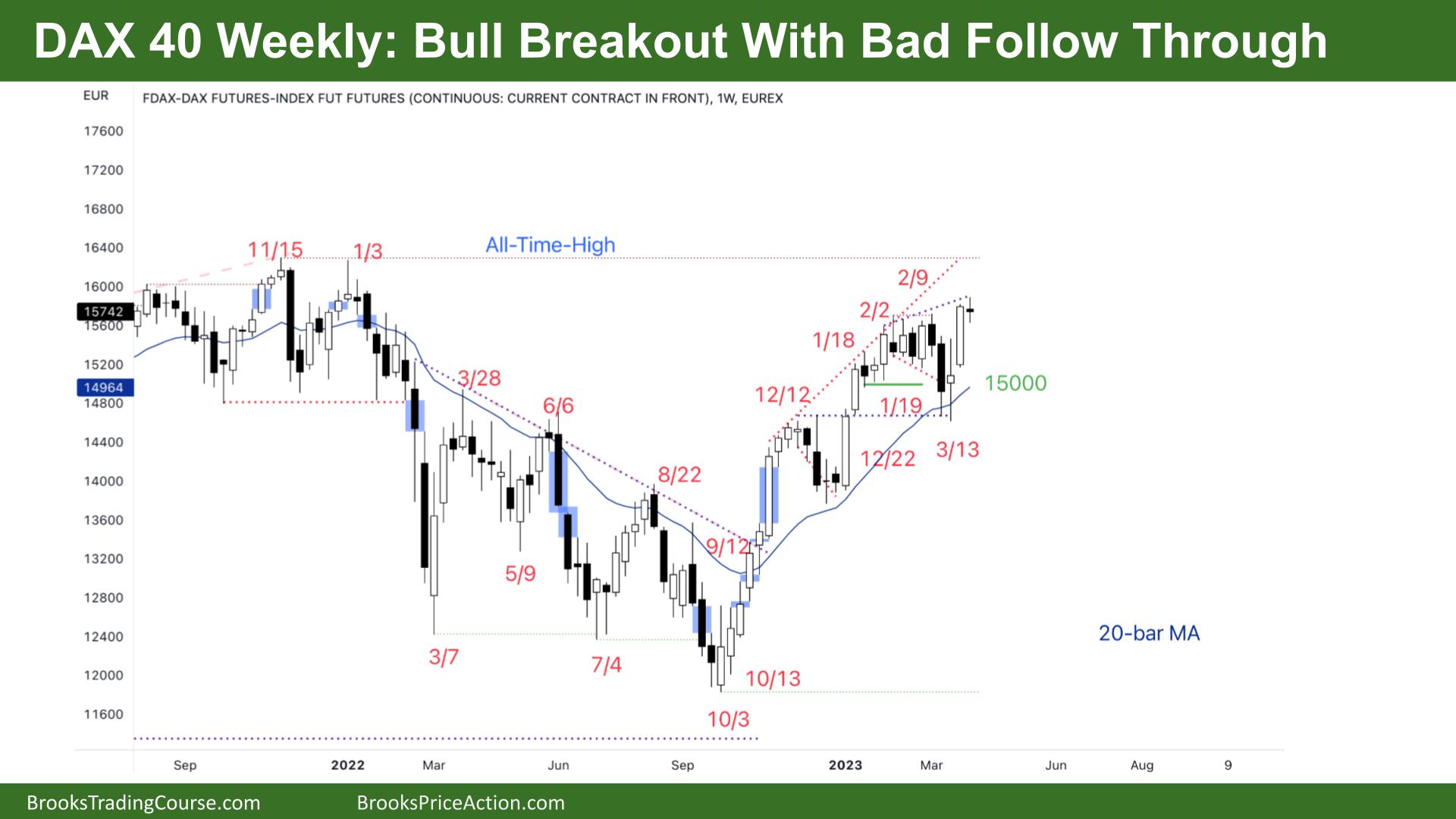

The Weekly DAX chart

- The DAX 40 futures was a small bear doji on the weekly chart – a pause after a strong bull breakout, so it was a bad follow-through bar.

- It has been sideways for 10 weeks in what looks like the final flag of a strong bull channel since October.

- We are forming an expanding triangle. This a test of a wedge top, so a wedge bottom on a lower timeframe as well as we expected buyers at the moving average – bears are still unable to get a weekly close under it.

- The trend is strong; most bulls have transitioned to buying below bars and pullbacks.

- The lack of follow-through buying this week was reasonable, considering how high it was in a tight trading range. Most bulls want to wait for confirmation before buying above it.

- A bear doji is a bad buy signal, even if the directional probability is still up.

- The bears want next week to close last week’s low – a failed breakout with follow through below. This kind of reversal pattern could move quickly.

- Bears sold above the doji around March 13th. The big doji with a small body is a weak buy signal, so we might trade back towards it to let the bears out.

- The bull bar last week was strong, so traders will likely expect a second leg sideways to up. The bull breakout needs another bar to confirm.

- If we fail to get sellers below the low next week, we might move quickly to the all-time high area. FTSE hit a new All-Time High, so some traders might expect DAX to do similar.

- You can see on the chart the lack of gaps since November as bulls closed the bear breakout from Feb 2022. I suspect 15000 will be important, especially now that the MA is so close to it.

- Bulls can buy one more bar, but the profit target is shrinking, and the size of the bear bars is strong – the bears got consecutive bear bars a few weeks ago – so a reasonable place for limit-order bears to short.

- Expect sideways to up next week – unless we find sellers under that doji – then the target would be the top of the bull doji to close that gap.

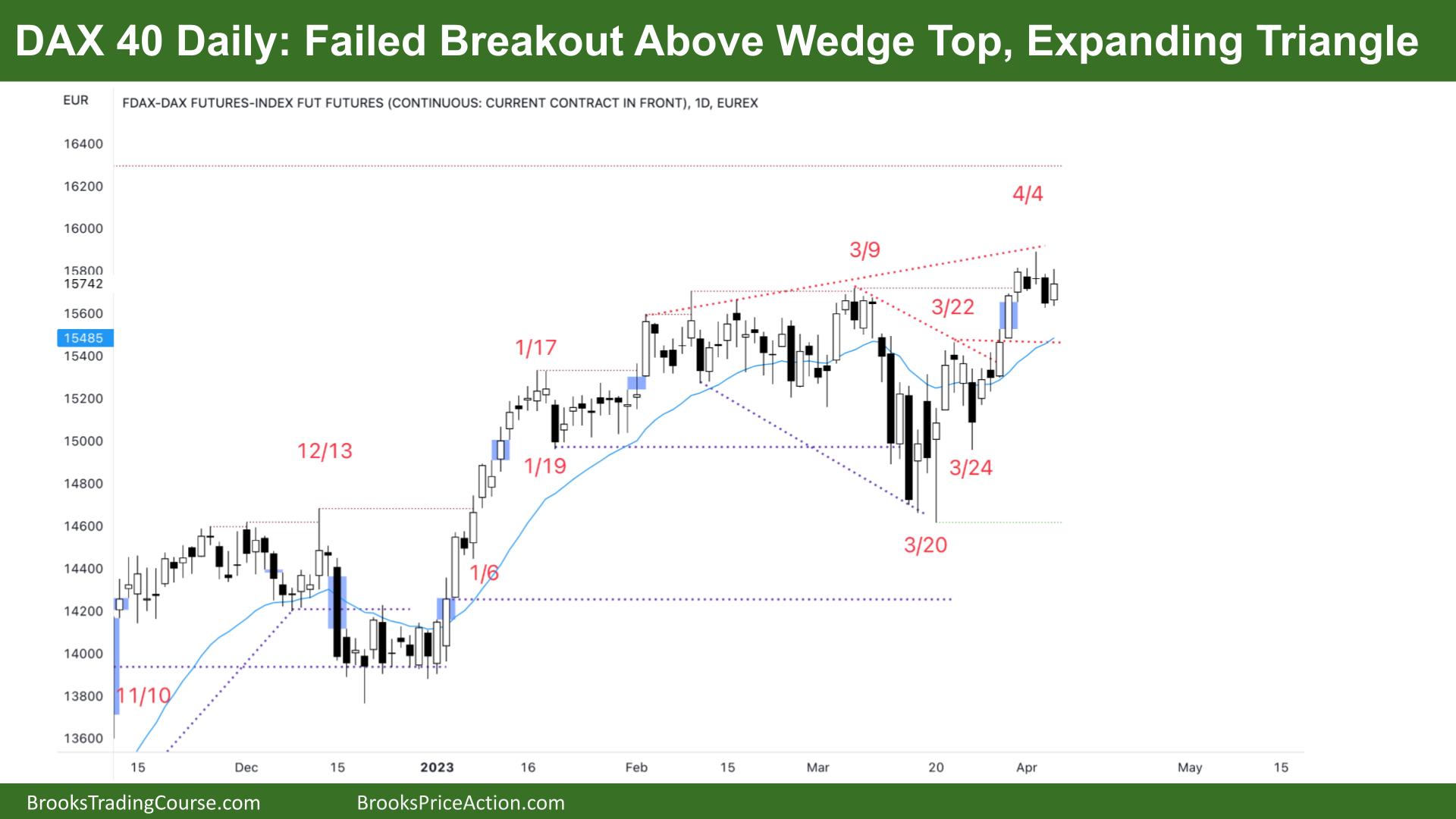

The Daily DAX chart

- The DAX 40 futures was a bull bar on Friday with a prominent tail above.

- It was a sideways week, so we will likely get more sideways next week.

- Tuesday was an inside bar, so reasonable sell above on Wednesday.

- Wednesday was a perfect doji with a big tail above, so bears scalped a measured move down. They saw the expanding triangle and have been selling prior highs 4 times and making money each time.

- Thursday was a strong bear bar but no follow-through. This was reasonable to exit and a low probability swing position because of the 3 consecutive big bull bars last week with a large micro gap.

- The bears broke a major swing low from Jan 19th. We might have entered a trading range here. The target after that break is the prior high where we are stalling.

- Some bears are looking for follow-through under Thursday to swing short back to the moving average.

- But it’s been tough for stop-order bears to make money. A reasonable target for them is likely the Mar 22nd prior high. That is the open breakout gap and the moving average.

- Bulls might wait for a second leg sideways to down to buy – the MA is the middle of this expanding triangle, so better math is found lower down. Getting a breakout and follow-through above Wednesday might help them reload for a move back to the all-time high.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.