Market Overview: Crude Oil Futures

The Crude oil futures bears got a weak follow-through selling on the weekly chart. They hope that this week was simply a pullback and want another leg down breaking below Jan/Feb lows. The bulls want a reversal up from a wedge bull flag and a higher low major trend reversal.

Crude oil futures

The Weekly crude oil chart

- This week’s candlestick on the weekly Crude Oil chart was a bear doji with a long tail below and a prominent one above.

- Last week, we said that traders will see if the bears can create a follow-through bear bar. If they do, we may get another retest of the trading range low.

- While this week traded below last week’s low, it reversed to close above it. The bears did not get strong follow-through selling.

- The bulls want a failed breakout below the September low and the bull trend line.

- They hope that the last 2 weeks were simply a deep pullback and want a reversal up from a wedge bull flag (Jan 5, Feb 6 and Feb 22) and a higher low major trend reversal.

- They want a retest and breakout above the 14-week trading range high, exponential moving average and bear trend line.

- The bulls need to break far above these resistances with follow-through buying to increase the odds of higher prices.

- The bears got a reversal down from a double top bear flag (Dec 1 and Jan 18) but failed to get follow-through selling.

- They then got another leg down from a wedge pattern (Jan 3, Jan 18 and Feb 13) but did not get strong follow-through selling once again.

- If Crude Oil trades higher, they want the market to stall around the trading range high and the 20-week exponential moving average.

- The last 14 candlesticks are overlapping sideways. That means Crude Oil is in a trading range.

- Poor follow-through and reversals are more likely within a trading range.

- Traders will BLSH (Buy Low, Sell High) until there is a breakout from either direction.

- So far, the bears have tried to push lower 3 times within the trading range but the follow-through selling has been weak.

- If the bears do not start creating strong consecutive bear bars soon, odds will swing to a bull leg testing the 14-week trading range high within a few weeks.

- For now, traders will see if the bears can create another leg down by breaking below January/February lows, or if Crude Oil continues to stall around 72-73 which will likely lead to a stronger upside push.

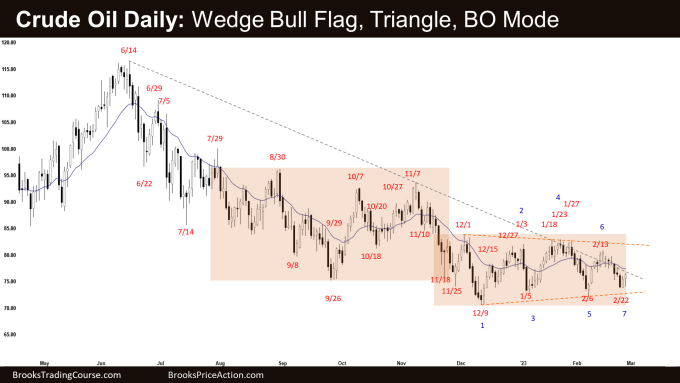

The Daily crude oil chart

- Crude Oil broke below the inside bar on Wednesday but there was no follow-through selling.

- Last week, we said that Crude Oil is in a trading range and poor follow-through and reversals are more likely within a trading range.

- The bears got a reversal lower from a double top bear flag (Jan 3 and Jan 18) but were not able to get follow-through selling below the January low.

- They then got another leg lower from a wedge bear flag (Jan 3, Jan 18, and Feb 13) but did not get follow-through selling this week.

- They want a retest and breakout below the December low forming the larger wedge pattern with the first two legs being September 26 and December 9.

- They need to create strong consecutive bear bars to increase the odds of lower prices.

- If Crude Oil trades higher, they want it to stall around the trading range high and reverse lower again.

- The bulls want a failed breakout below the September – November trading range and the major bull trend line.

- They want a reversal higher from a wedge bottom (July 14, Sept 26 and Dec 9), a wedge bull flag (Jan 5, Feb 6, and Feb 22) and a higher low major trend reversal.

- They want another leg up breaking above the 14-week trading range high.

- For now, Crude Oil is in a 14-week trading range. Traders will BLSH (Buy Low, Sell High) until there is a breakout from either direction.

- Poor follow-through and reversals are more likely within a trading range.

- Markets have inertia and tend to continue to do what they have been doing.

- Crude Oil formed a triangle pattern and is in breakout mode.

- After 3 attempts to push lower with weak follow-through selling, we may see another attempt to test the trading range high soon.

- For now, traders will see if the bears can create follow-through selling below January/February lows or if Crude oil will stall around 72-73 and attempt an upside breakout within a few weeks.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Fascinating dynamics at work in the oil market. The DOE is mandated to sell oil for the next few years but is also looking to buy oil near the low of the current TR to replenish the SPR which is at a 40 year low.

Dear Andrew,

A good day to you..

Yeah, further add the Ukraine-Russia war and others into the mix..

Thanks for going through the report.. Wishing a great week ahead to you..

Best Regards,

Andrew