Market Overview: Crude Oil Futures

The weekly chart is in the Crude Oil pullback phase which has lasted 10 weeks so far. The bulls need to create sustained follow-through buying above the 20-day EMA and the bear trend line to increase the odds of the bull leg beginning. The bears see the recent sideways to up pullback as forming a wedge bear flag, with the first two legs being December 26 and January 29.

Crude oil futures

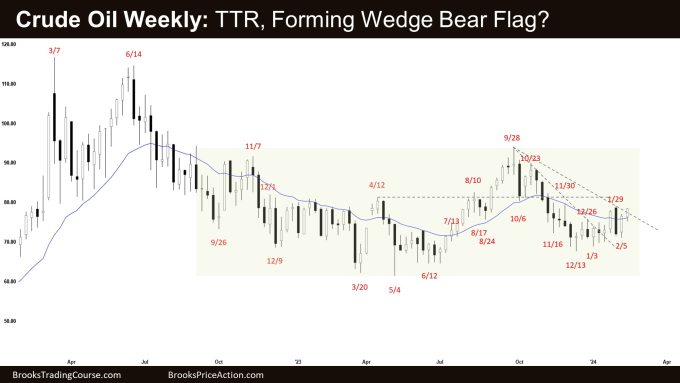

The Weekly crude oil chart

- This week’s candlestick on the weekly Crude Oil chart was a bull bar closing near its high.

- Last week, we said that the market may still be in the sideways to up pullback phase. Traders will see if the bulls can create a follow-through bull bar following last week’s close above the 20-week EMA.

- This week was a follow-through bull bar trading above the 20-week EMA. The bulls got what they wanted.

- The bulls see the selloff to the December 13 low simply as a bear leg within a trading range.

- They want a reversal from a higher low major trend reversal (Dec 13), a wedge bull flag (Oct 6, Nov 16, and Dec 13) and a small double bottom bull flag (Jan 13 and Feb 5).

- They will need to create sustained follow-through buying above the 20-day EMA and the bear trend line to increase the odds of the bull leg beginning.

- The bears see the recent sideways to up pullback as forming a wedge bear flag, with the first two legs being December 26 and January 29.

- They want the 20-week EMA and the bear trend line to act as resistance.

- They want another leg down to retest the prior leg low (Dec 13) and the trading range low (May low) after the current pullback.

- Since this week’s candlestick is a bull bar closing near its high, it is a buy signal bar for next week.

- For now, the market may still be in the sideways to up pullback phase.

- Traders will see if the bulls can create another bull bar, preferably closing above the January high.

- Until the bulls can create follow-through buying trading far above the January high, odds slightly favor at least a small sideways to down leg to retest the December low.

- Crude Oil is currently in an 80-week trading range. Traders will BLSH (Buy Low, Sell High) until there is a breakout with sustained follow-through buying/selling from either direction.

- The market is trading in the lower third of the trading range which is the buy zone of trading range traders.

- Poor follow-through and reversals are the hallmarks of a tight trading range.

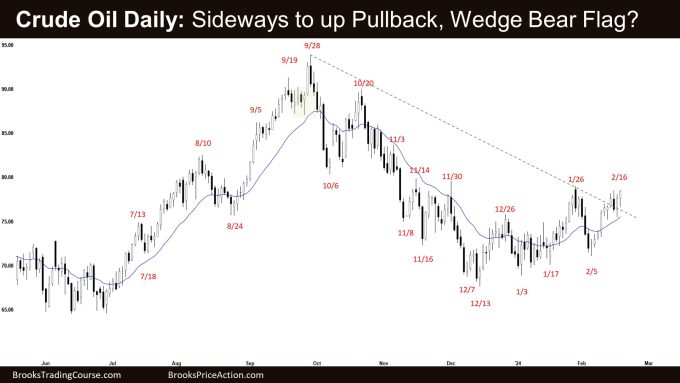

The Daily crude oil chart

- Crude Oil traded sideways to up for the week.

- Last week, we said that the odds slightly favor the market to still be in the minor pullback (sideways to up) phase.

- The bulls see the move down to December 13 simply as a bear leg within a trading range.

- They got a reversal from a wedge pattern (Oct 6, Nov 16, and Dec 13) and a double bottom bull flag (Dec 13 and Feb 5).

- They hope to get a breakout above the January high followed by the beginning of the bull leg to retest the September high.

- The bulls will need to create consecutive bull bars closing near their highs, trading far above the January high to increase the odds of the bull leg beginning.

- The bear sees the current pullback as forming a wedge bear flag with the first two legs being December 26 and January 26.

- They want a retest of the December low after the current pullback.

- If the market trades higher, they want a reversal from around the January high area or slightly above it.

- For now, odds slightly favor the market to still be in the minor pullback (sideways to up) phase.

- Traders will see if the bulls can create sustained follow-through buying or will the market stall around the January high area.

- If the bulls can get a series of consecutive bull bars closing near their highs, trading far above January high, it can swing the odds in favor of the bull leg beginning.

- Until then, odds slightly favor the 10-weeks sideways to up pullback to be minor and favor at least a small leg retesting the December low after the pullback.

- Crude Oil remains in an 80-week trading range. Traders will BLSH (Buy Low, Sell High) in trading ranges until there is a breakout with sustained follow-through buying/selling.

- Most breakouts from a trading range fail 80% of the time. Odds slightly favor the trading range to continue.

- Poor follow-through and reversals are the hallmarks of a trading range.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.