Market Overview: Bitcoin Futures

Bitcoin reversal from new low this week. It remains slightly below crucial resistances after reaching new fresh lows of the major bear trend, by trading sideways to down.

Bitcoin futures

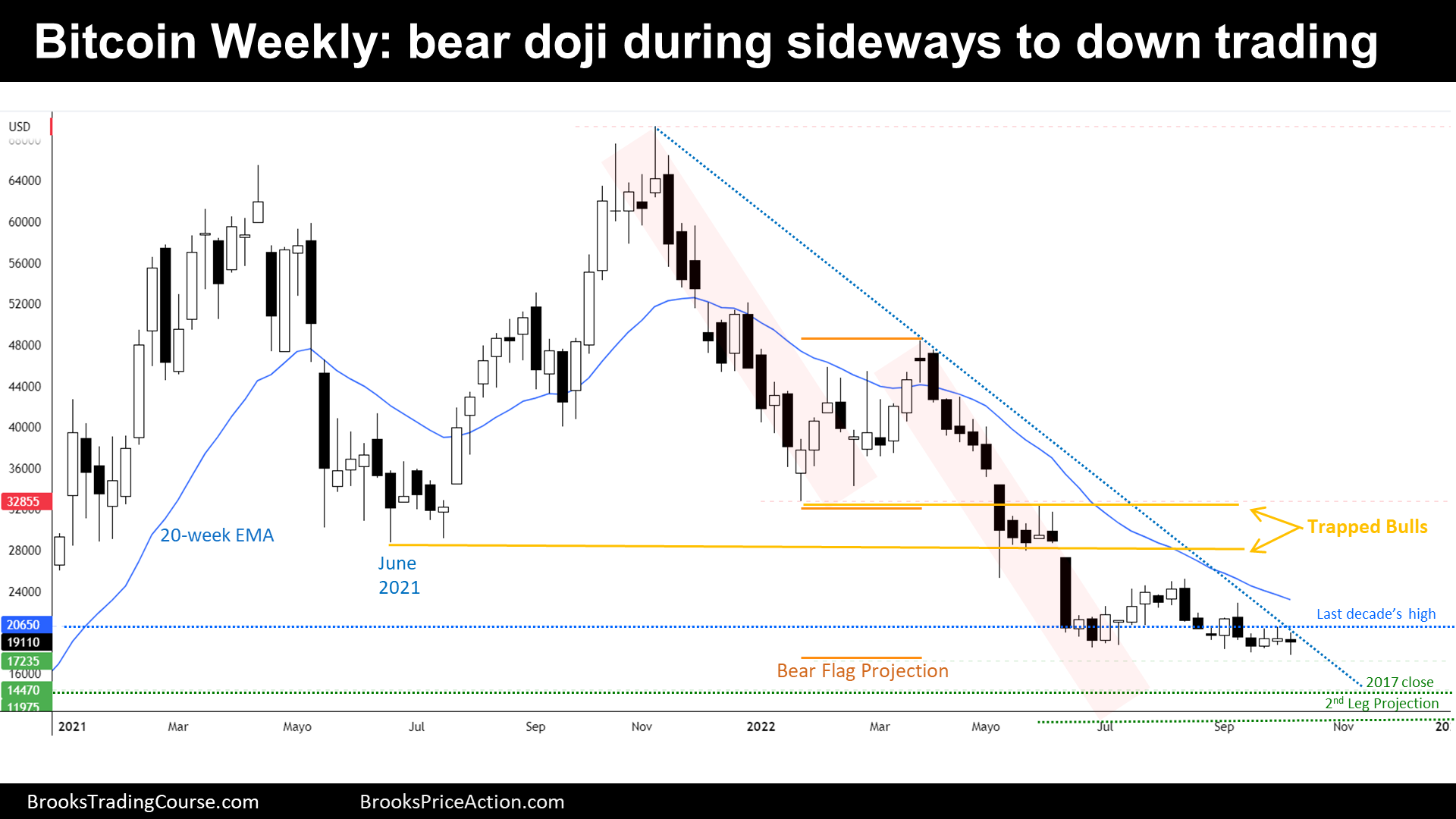

The Weekly chart of Bitcoin futures

- This week’s Bitcoin candlestick is a small bear doji, closing near its midpoint.

- During the last report, we have said that we should expect sideways to down trading, and a bear doji is a pure representation of that.

- The price established a new low this year at $17810. Thereafter, it reversed up, closing above the prior year lows.

- Bears want bear closes below new lows, but every new low was bought since June, and that might indicate that bears are not as strong as they could be.

- Bulls want to break up the top of the bear trend line, but also since June, they only managed to slow down the velocity of the bear trend. A bear trend that is continuing by creating recurrent lower lows.

- Bulls need to break up to top of the bear trend line and start to get consecutive bull bars if they want to stop the bearish inertia. The price is at the limit of a major support: at around 2017 highs or past decade’s highs.

- Bears feel confident while the price remains below the top of the bear trend line. They think that bulls are weak and that soon there will be a sell climax to at least $17235, the measured move of a major bear flag.

- This week’s candlestick is a bear doji that stalled either at the top of the bear trend line and at new lows. It is very neutral for next week, odds are balanced.

- But since the price is within a bear channel, odds slightly favor lower prices next week.

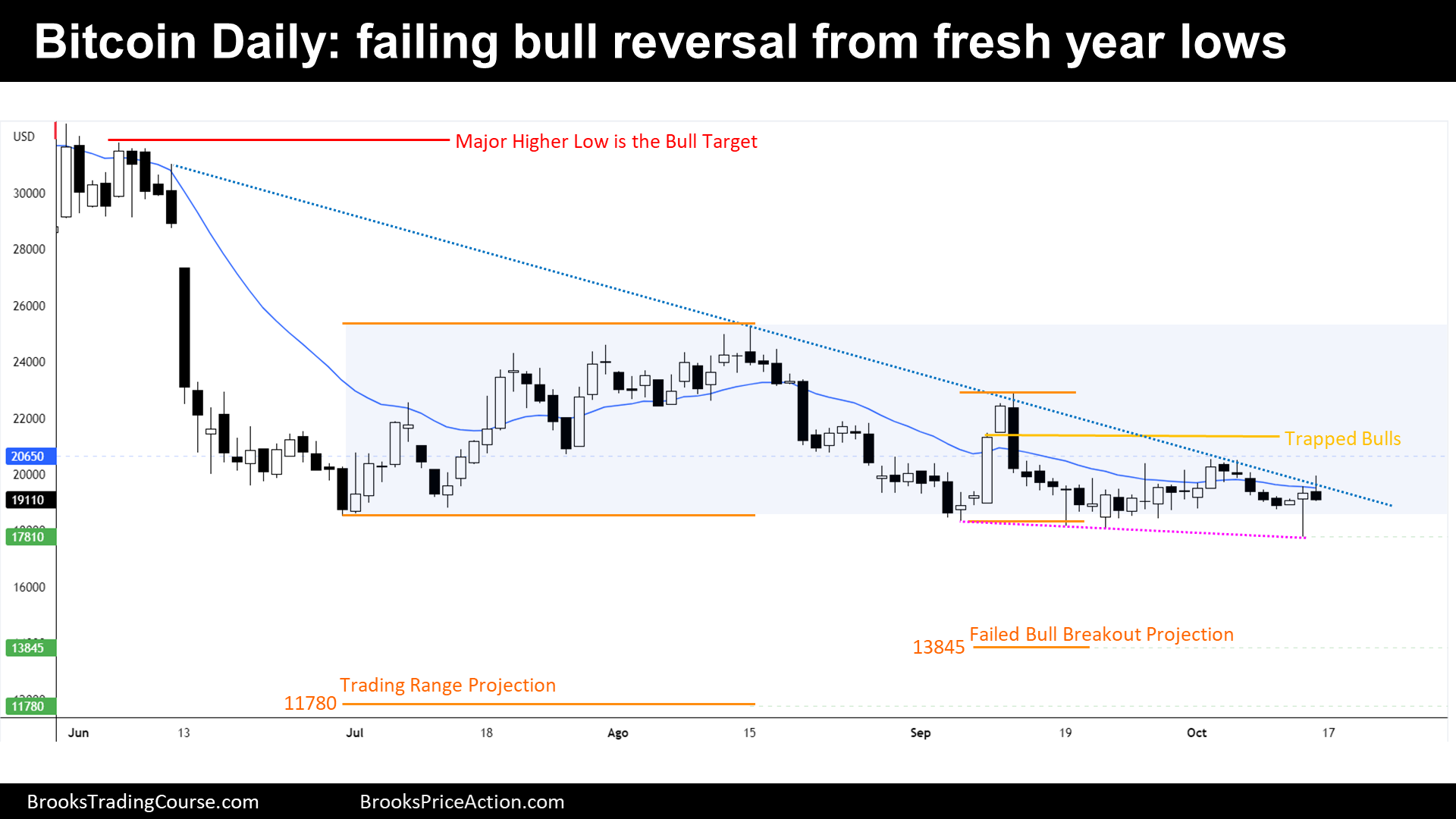

The Daily chart of Bitcoin futures

- During the week, the price traded down until achieving a new low of the 3-month trading range.

- Then it reversed up, creating the bull reversal bar on Thursday, that was following a wedge bottom.

- On Friday, the bulls got awful follow through. Actually, Friday was a good bear reversal bar within a good context for the bears because it stalled at the top of the bear trend line and also at the 20-day exponential moving average. It is also a double top lower high.

- Bears can reasonably sell below Friday’s low.

- Bears want to break down the wedge bottom. If they do so, the odds are that the price will experience at least a two legs sideways to down move.

- Bulls think that the price it is within a buy zone of a trading range, and that trading range price action prevails. They think that below good bear stop entry setups, there will be buyers.

- Truth is that since September, it was a profitable strategy to buy below good bear stop entry setups, if located within the buy zone of the trading range.

- Bulls can reasonably buy below Friday’s low.

- Both bulls and bears will take, reasonably, the opposite trade on Monday.

- Probability is better for bears, and risk-reward ratio is better for bulls.

- Because odds favor slightly the bears, we should expect lower prices next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.