Market Overview: Bitcoin Futures

The Bitcoin futures lost 30% of its value during the week with a Bitcoin bear flag breakout – recording a new low for this year. Now, the price is testing the 2017 close, the most important price level of the Bitcoin Futures.

Bitcoin futures

The Weekly chart of Bitcoin futures

- This week’s candlestick is a huge bear breakout bar with a prominent tail below.

- Last week we have said that the odds favored bulls, but instead, the price made a rapid move down.

- This move occurs after a tight trading range; therefore, traders need to confirm the bear breakout with a good follow through bar. If that does not happens, traders might see a final flag pattern and will buy above a bull bar.

- As we can see on the chart, during the bear channel there are multiple wedges, which normally signals trading range price action. Our core view is that the price is within a trading range, and it will experience a bull leg testing $30000 at some point in the near future.

- We are not sure yet of where is the bottom of the hypothetical trading range, but it might be around $15000. We have been saying since June that the 2017 close is probably the most important price of bitcoin, because it was the first year close after the futures inception, and that should be viewed as a crucial consensus price. Within trading ranges, price tends to test all significant prices.

- Bears got an essential achievement, by trading until the bear flag measured move. Now they want to get to around $12000 to complete the major Leg 1/Leg 2 projection.

- Bulls want a bull bar next week, they will consider that the tight trading range breakout is failing, which is common.

- Because the price is at a major support, we should expect bullish pressure around current prices.

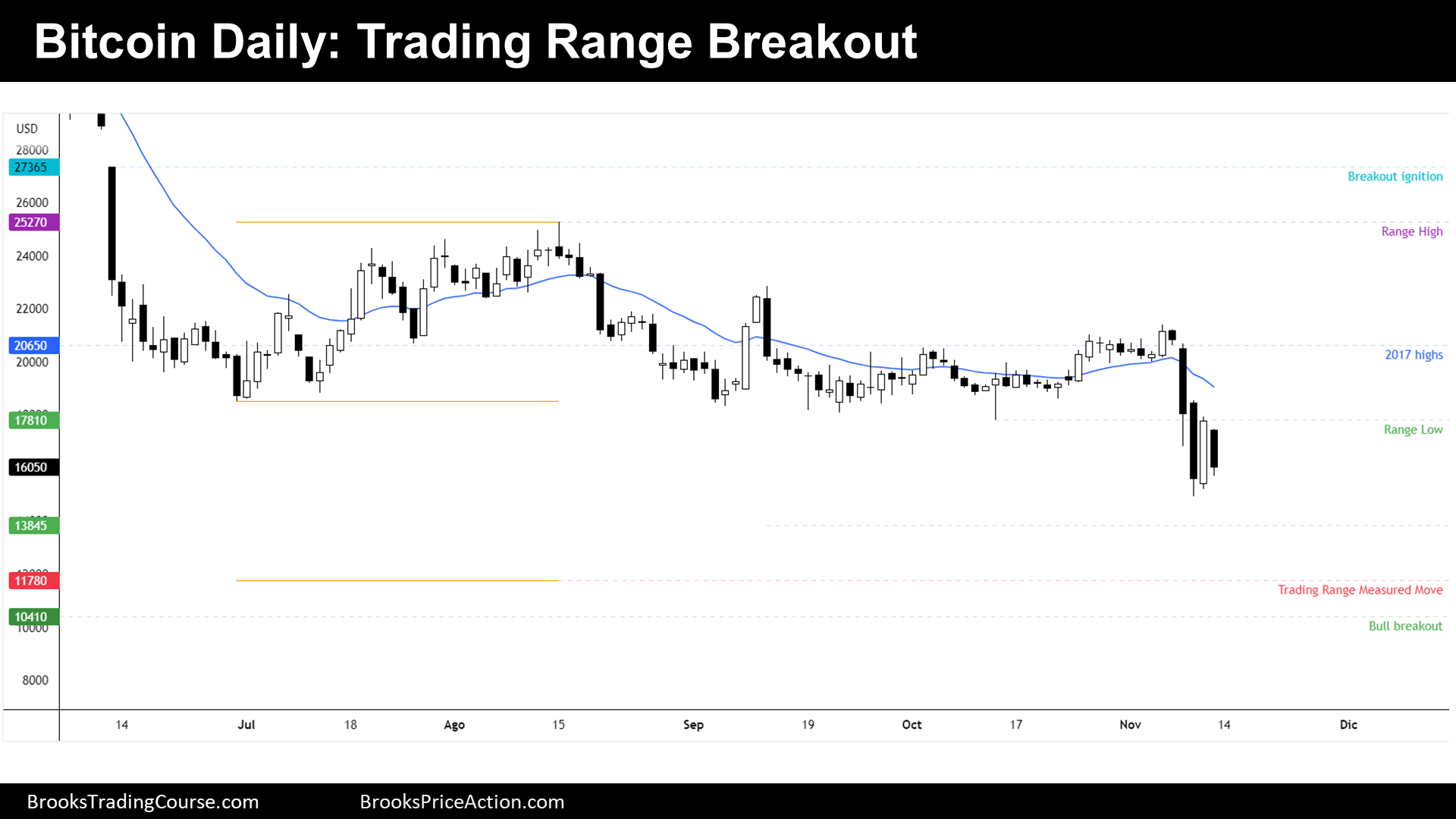

The Daily chart of Bitcoin futures

- This week, the price broke down below the 4-month trading range after a double top at 2017 highs price level.

- The bear breakout was in the form of a surprise, the bars were huge compared to what was on the left. Is this a breakout, or is this a climax? We do not know.

- After the bear breakout, bulls recovered almost 50% of the fall, which should be viewed as weak bears; However, the breakout was strong enough to expect a second leg sideways to down.

- If there are 50% retracements during bear breakouts, the context is more likely a broad bear channel than a small pullback bear trend, hence, bull buying below lower lows will probably make money if they manage their trade well. This is why I do not expect a strong trend down.

- Thursday and Friday are inside bars, therefore, a breakout mode pattern. Bears want a continuation of the bear trend. Bulls want the bears to fail and return to the trading range. Because Thursday was an unexpected strong bull day, some bears that sold around Wednesdays low might exit their trade because they were expecting something different.

- But before bears fail, the context favors lower prices. And the bears want to achieve a measured move down until the trading range measured move target.

- As we mentioned on the weekly chart, we are at support and if traders see hesitation during the following days, the odds might shift in favor of the bulls because of the major support.

- If you are trading crypto these days, beware of the current difficult market environment and keep your risk reasonably controlled.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.

Josep thanks for the report.

There are many big tech companies out there that have dropped 60%-80% from their high as of early 2022 and so does Bitcoin. However this is the 1st time that Bitcoin reacts differently to what the market does, in particular last Thursday/Friday bullish move by the market. What are your thoughts on that?

Hi Eli! It is nice to hear you again at the comments :).

I think bitcoin should be compared against Real Assets like Reits or gold. Or at least against companies that commercialize real assets. That being said, that move down when other similar assets performed well seems to me irrational (news that does not afect the asset fundamentals, hence, i think the price, literally, undervalued and a huge opportunity to buy right now. Maybe I’m completely wrong with this view, but that is my opinion.

Have a great week ahead, Eli!