Market Overview: Bitcoin Futures

Bitcoin consecutive bear bars. This week, the price decreased by -9.67% of its value. A leg down started after entering the sell zone a couple of weeks ago. Traders expect trading range price action for the upcoming months instead of a bear trend resumption.

Bitcoin futures

The Weekly logarithmic chart of Bitcoin futures

Analysis

- This week’s candlestick is a big bear breakout bar with a prominent tail at the low end. It is the 3 consecutive bear bar after reversing down from the reversal patterns formed at resistances.

- A prominent tail at the low end of the bar indicates that there were some buyers, probably profit takers at around a 50% pullback, the apex of the triangle or at the filled gap.

- Three consecutive bear bars suggest that even if there is a reversal up from here, traders should expect at least another leg sideways to down.

- We have been saying throughout the reports that the market cycle is most likely a trading range, not a bear trend, neither a major bull trend reversal.

- During trading ranges, the price tends to close gaps since traders buy low and sell high, at prior lows and prior highs.

- Traders sold above the August 15th high.

- They will probably buy below the major higher low.

- Moreover, they tend to take quick profits and confuse trend traders, that end up buying too high or selling too low.

- January’s bull breakout was strong and hence, traders might consider that this pullback is just a bull flag.

- But bears are closing gaps, and thus, the bulls know that the chances of a strong bull trend coming out the January’s breakout is not likely.

- Nowadays, the price is either:

- Bull case: They know that the chances of a bull major trend reversal are low meanwhile there are trapped bulls at the June 2021 low (they will add a lot of selling pressure limiting the upside); Therefore, what they desire is another bull leg starting here and get a leg 1—leg 2 measured move, up to the major lower high or, at least, up to June 2021 low.

- Bear case: They achieved the goal of closing important gaps, so they know that the bulls are not as strong as they could be; Hence, they will sell a reversal up knowing that at some point the price will test back to current prices, which is the apex of a triangle.

- Since the bear momentum has been strong, traders should expect sideways to down trading during the upcoming weeks.

Trading

- Bulls:

- They want either a huge bull breakout bar or a micro double bottom forming at current prices. Buying a 50% pullback after 3 consecutive bear bars without overlap between prior bars might not be the best of the ideas.

- Bears:

- It is hard to sell below bars when there is a trading range on the left side of the chart. They will probably sell the first low 1. More likely, they will sell during an hypothetical way up, using wide stops (up to around $50000) and scaling in, knowing that the price will likely test the current prices in the future.

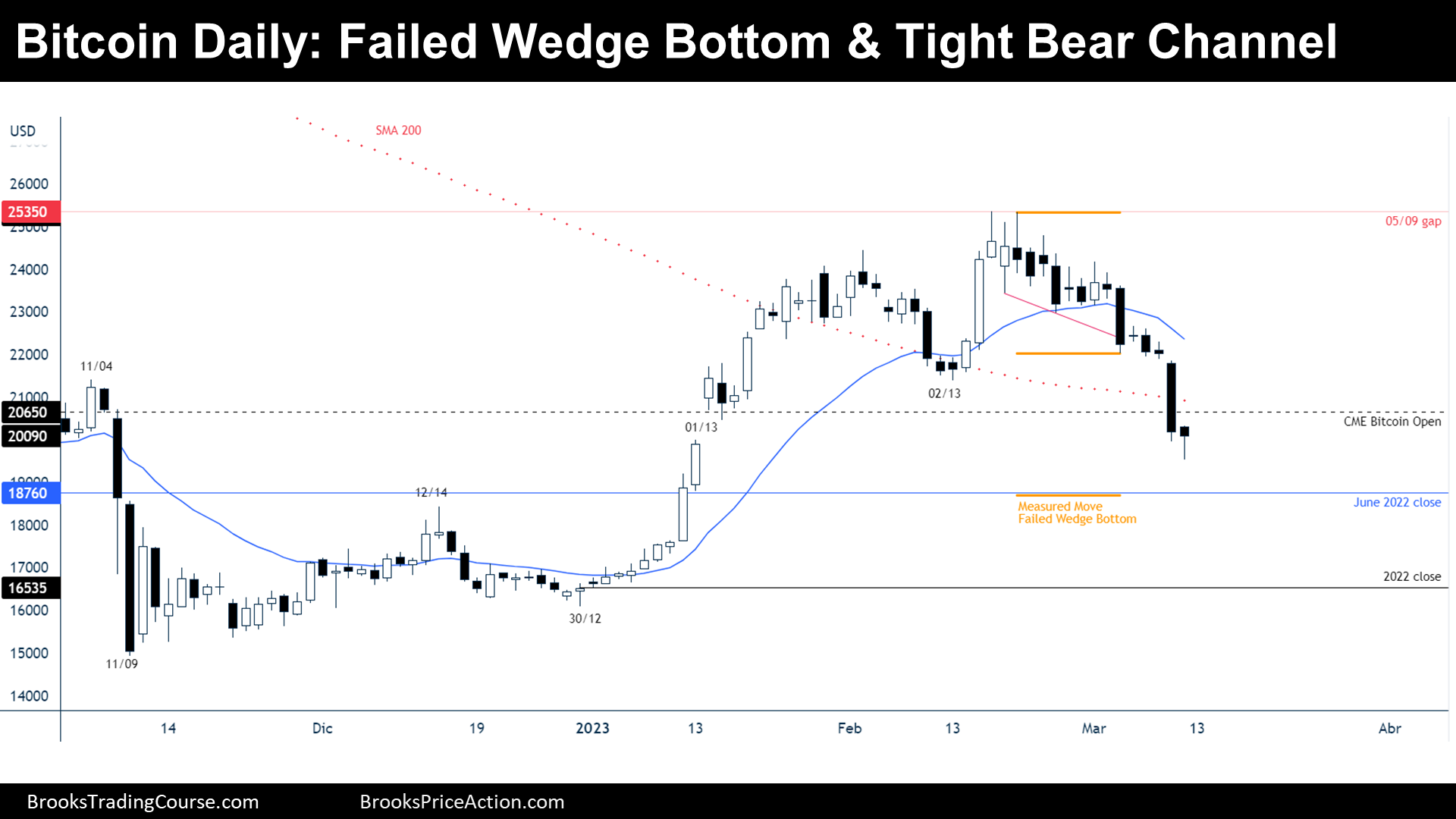

The Daily chart of Bitcoin futures

Analysis

- During the week, the price broke below a wedge bottom, forming a bear breakout market cycle. The price created an 8-bar bear micro channel.

- When there is a bear breakout of a wedge bottom, traders should expect at least two legs down. Bears want to achieve a measured move based upon the size of the wedge bottom.

- Bears were fiercely strong, gapping down and following the downside fall; hence the bear channel is tight, and the first reversal up will probably be minor.

- But nowadays, this looks climatic, the price is far from the 20-day exponential moving average and thus, traders will hesitate to sell this low.

- Friday was a bear bar closing above its midpoint and Thursday’s low, that might disappoint bears who sold low and thus, a pullback starting the next 1-3 days should be expected.

- Nowadays, the price is either:

- Bull case: while the price is above the major lower high at December 30th low, bulls view this as a broad bull channel, since the January’s bull trend was strong. Hence, they expect a reversal at around current prices.

- Bear case: bears want to keep trending down, they hope that if there is a pullback starting soon, there will be a lower low after that and a bear channel will be created by then. Their goal is to get to the major higher low, to end, technically, the broad bull channel market cycle.

Trading

- Bulls: The pullback is strong and deep, their chances of getting new highs soon are low. However, they think that there will be a test of February’s high at some point and there is a lot of room for good profits from here, and hence, they will buy a reversal up if they see big bull reversals or after bottoming patterns.

- Bears: The bears are looking to sell a bear flag, or a pullback at around 50% retracement of the bear breakout.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.