Market Overview: Bitcoin Futures

Bitcoin futures Bear Breakout of a Tight Trading Range on the daily chart. During the week, the value of the crypto asset decreased by 11.69%, and now is testing the HSB breakout point. Traders wonder if this is the end of the bull channel or if the price will reverse up from supports.

Bitcoin futures

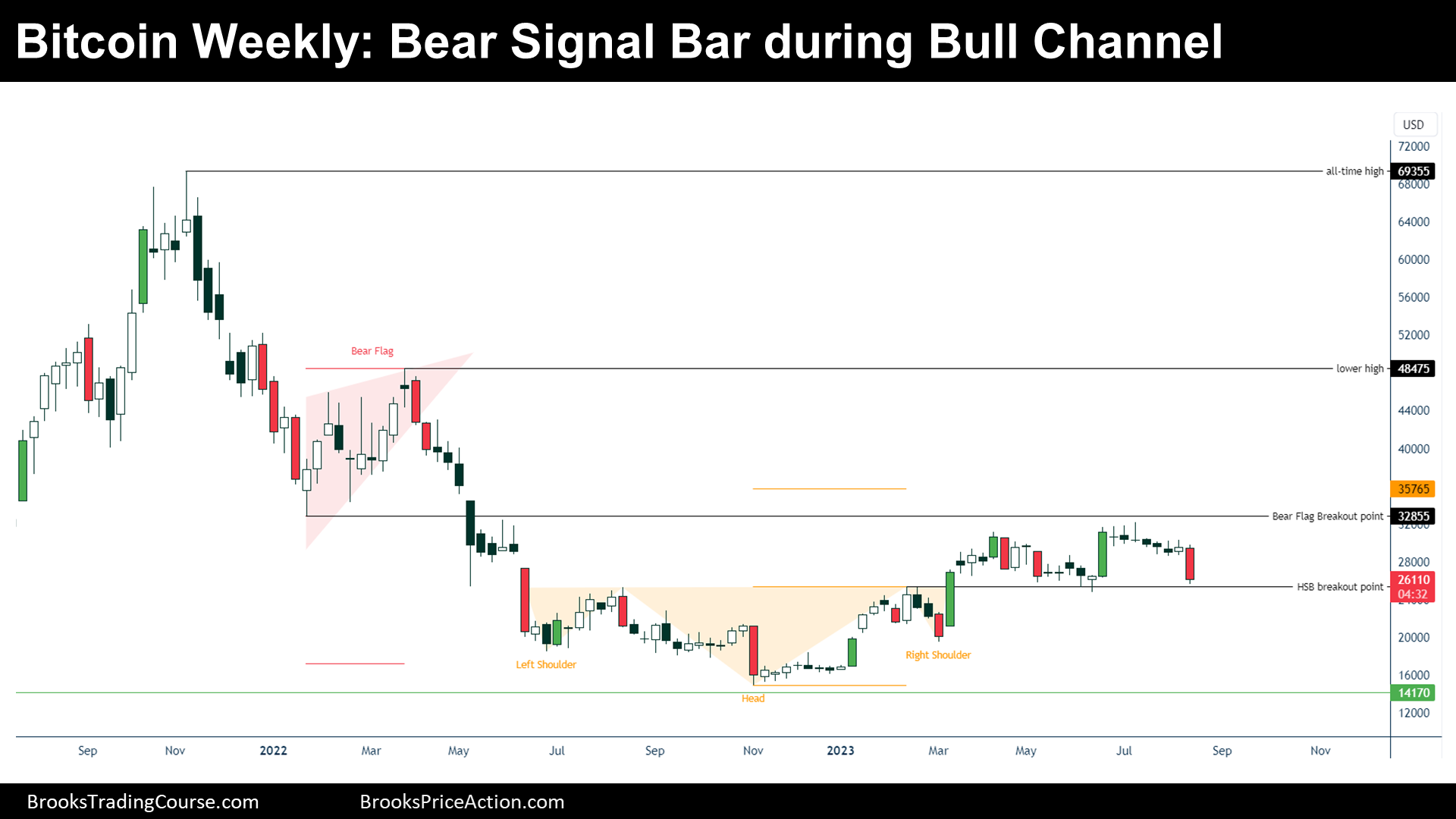

The Weekly chart of Bitcoin futures

Past (Supports & Resistances)

“Every market probes up and down to discover how far is too far, which then becomes support and resistance. Once traders understand this and how to spot logical support and resistance levels, they are in a position to begin trading.” — Al Brooks.

- During 2022, the price created a Bear Flag pattern and then did a strong bear breakout, creating the following resistance levels:

- Major Lower High.

- Bear Flag Breakout Point at $32855.

- Thereafter, the price did a bottoming pattern:

- Head and Shoulders Bottom (HSB).

- Bear Trend Low (2022 low).

- During March 2023, the price did a bull breakout of the HSB:

- HSB Breakout Point.

- HSB Measured Move.

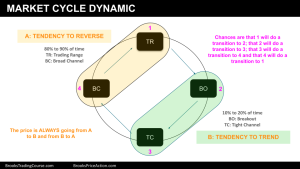

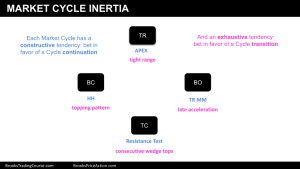

Present (Market Cycle)

The current market cycle is unclear. There is a bull channel and traders question if the bull channel is a small pullback bull trend (tight channel), or a broad bull channel.

- In favor of a Small Pullback Bull Trend:

- After the bull breakout of the HSB, the price did a test of the HSB breakout point and then reversed up.

- The price created a Body Gap (Negative Gap), which means that there was not a weekly close below the HSB Breakout Point.

- The price reached a Higher High after the Body Gap.

- After the bull breakout of the HSB, the price did a test of the HSB breakout point and then reversed up.

- In favor of a Broad Bull Channel:

- During the bull channel, there were two 50% retracements of bull legs.

- 2022 was a strong bear trend. The way up is full of trapped bulls that add selling pressure.

During Small Pullback Bull Trends, there is always the sensation that the price it is going to reverse, unless there is a bull breakout after a long duration trend, or consecutive wedges. However, on the left of the chart (“Past” section) there is a strong bear trend, and that it is not positive for Small Pullback Bull Trend trading strategies: bear trends trap bulls into the wrong trade and during a reversal up they sell.

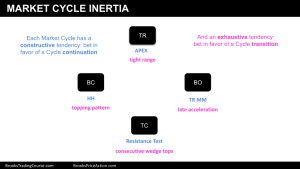

Future (Inertia)

- If Small Pullback Bull Trend:

- The market will test the bear flag breakout point at $32855.

- HSB Measured Move.

- If Broad Bull Channel:

- The market can either trade around the HSB breakout point and then reverse up to reach new highs of the trend.

- Or it can form a Lower High that creates a Head and Shoulders Top pattern.

Trading

This week’s candlestick is a bear breakout bar and signal bar, but the context it is not good for the bears to sell below the signal bar since the price comes from a bull trend. The reversal down will not, presumably, go very far.

- Swing Bulls:

- Small Pullback Bull Trend:

- They bought at the 20-EMA, a reversal up from 20-EMA, a bull flag or High 2.

- Stop Loss is at the Right Shoulder’s low.

- Broad Bull Channel:

- They will buy at or during a reversal up of the HSB breakout point, or at or during a reversal up from the right shoulder low (major higher low).

- Stop Loss is at the 2022 low.

- Small Pullback Bull Trend:

- Swing Bears:

- Broad Bull Channel:

- They will sell after a topping pattern is created, such as a wedge top or a Head and Shoulders Top.

- Stop Loss will be at the topping pattern’s top.

- Broad Bull Channel:

The Daily chart of Bitcoin futures

Past (Supports & Resistances)

- There was a Bull Breakout of a Bull Flag and then the price went sideways.

- Bull breakout low.

- 2023 top.

- Apex Trading Range

Present (Market Cycle)

- During the last weekly report, we have said that we were expecting a breakout soon because the price was doing a tight range within a trading range.

- This week, the price did a bear breakout of a tight trading range, evidencing that the market cycle is a Trading Range.

Future (Inertia)

This current Bear Breakout of a Tight Trading Range might evolve in a bear trend, but for now, it is likely to go to the Bull Breakout low. Then, Traders should expect an attempt to reverse up to the Apex of the Trading Range.

Trading

Thursday was a bear signal bar (red bar) that did a bear breakout of a tight trading range. The bear signal bar already did a measured move down based upon its body. Now, the price it is likely to follow the bear inertia, at least for a second leg sideways to down. Moreover, it is probably going to the breakout low because there, there is liquidity.

Many Traders would rather not trade during a Trading Range market cycle. Reversals are common, and this means that many trades will be in a loss at some point before the price does what it is meant to do (trade towards the Apex). Traders usually trade smaller and use wide stops.

- Swing Bulls:

- The context is a Trading Range, and therefore, they think that this is a just bear climax and want to buy a reversal up, but they should wait for a bull surprise before buying or at least a high 2.

- Swing Bears:

- They are likely too low now for selling, and they may want to wait for a test of a 50% pullback, or at the Apex of the Trading Range.

Market analysis reports archive

You can access all the weekend reports on the Market Analysis page.

Thank you Josep. Do you do analysis for smaller time frame charts as well?

Hi Piotr, thank you for your comment. I do not do that yet, but I may do in the future.

Wishing you a lovely Sunday.

Kr, Josep.