Market Overview: Bitcoin

The Bitcoin price ascended to meet the 2022 High price magnet, trading upward as expected. However, the narrative took a sharp turn thereafter, with a formidable reversal that saw the price plummet by over $7500. This week’s weekly bar is a Bear Reversal bar, prompting the pivotal question: Has the market initiated the long-anticipated Bear Leg that traders have been on the lookout for?

This week, the SEC finally approved a Bitcoin ETF. The iShares Bitcoin Trust, with the ticker IBIT, opens up new avenues for investors to participate in the Bitcoin market through traditional financial channels. This development further legitimizes the role of Bitcoin in the broader financial landscape. Looking forward to seeing how this ETF contributes to the accessibility and acceptance of Bitcoin on a larger scale.

Bitcoin

The prices depicted on our charts are sourced from Coinbase’s Exchange Spot Price. It’s crucial to note that the spot price of Bitcoin is continuously in motion; trading activity never ceases. This means that market fluctuations and price changes occur around the clock, reflecting the dynamic nature of cryptocurrency trading.

The Weekly chart of Bitcoin

Bitcoin’s 2022 high proved to be a formidable magnet, in line with our expectations. The current scenario presents a sell zone above the 2024 high, and then, looking downwards, we start to find the supports in the form of Bull Micro Gaps, the 50% retracement level, and crucially, the Breakout Point and Major Higher Low.

The current Market Cycle appears to be a Trading Range because the price is Trading within a prior, and recent, price range. Until a decisive breakthrough above this range occurs, or until the traders forget what is on the left (long enough time) traders are advised to Trade under Trading Range dynamics conditions.

A Bull Leg in a Trading Range is typically succeeded by a Bear Leg. The current Bull Leg is exhausted, as the Parabolic Wedge Top denotes. Moreover, the Bulls achieved their key targets, like the 2022 High, all this points towards an impending Bear Leg.

The pivotal question arises: is the Bear Leg already in motion? More often than not, the price tends to retesting significant levels, the possibility of a surprise surge above the 2024 high persists. However, as we will see on the Daily Chart analysis, the Bears can confirm the Bear Leg thesis on the Weekly chart by a Bear Breakout of the Daily Range. Until then, any potential surge to a new high in 2024 should be approached cautiously, considering the likelihood of it being a Bull Trap.

Post a Parabolic Wedge Top, market dynamics often lead to a couple of Legs Sideways to Down. Bears target the Breakout Point, and potentially, the Major Higher Low, where Weak Bulls’ Stop Losses are situated. Traders need to brace for a gradual shift in market momentum, signifying the initiation of a Bear Leg.

Bitcoin’s current market state is intricately navigating a Trading Range, with historical indicators pointing towards an anticipated Bear Leg. While a future Leg Up is anticipated to test current highs, caution is paramount due to the evident exhaustion of the existing Bull Leg and the formation of a Parabolic Wedge Top. Traders must meticulously monitor the Daily Chart for a potential Bear Breakout, as this could significantly alter the market trajectory. Until such confirmation, a strategic stance involves anticipating a potential Bear Leg, comprehending the significance of prior price levels, and approaching any hypothetical new highs with a warranted level of skepticism.

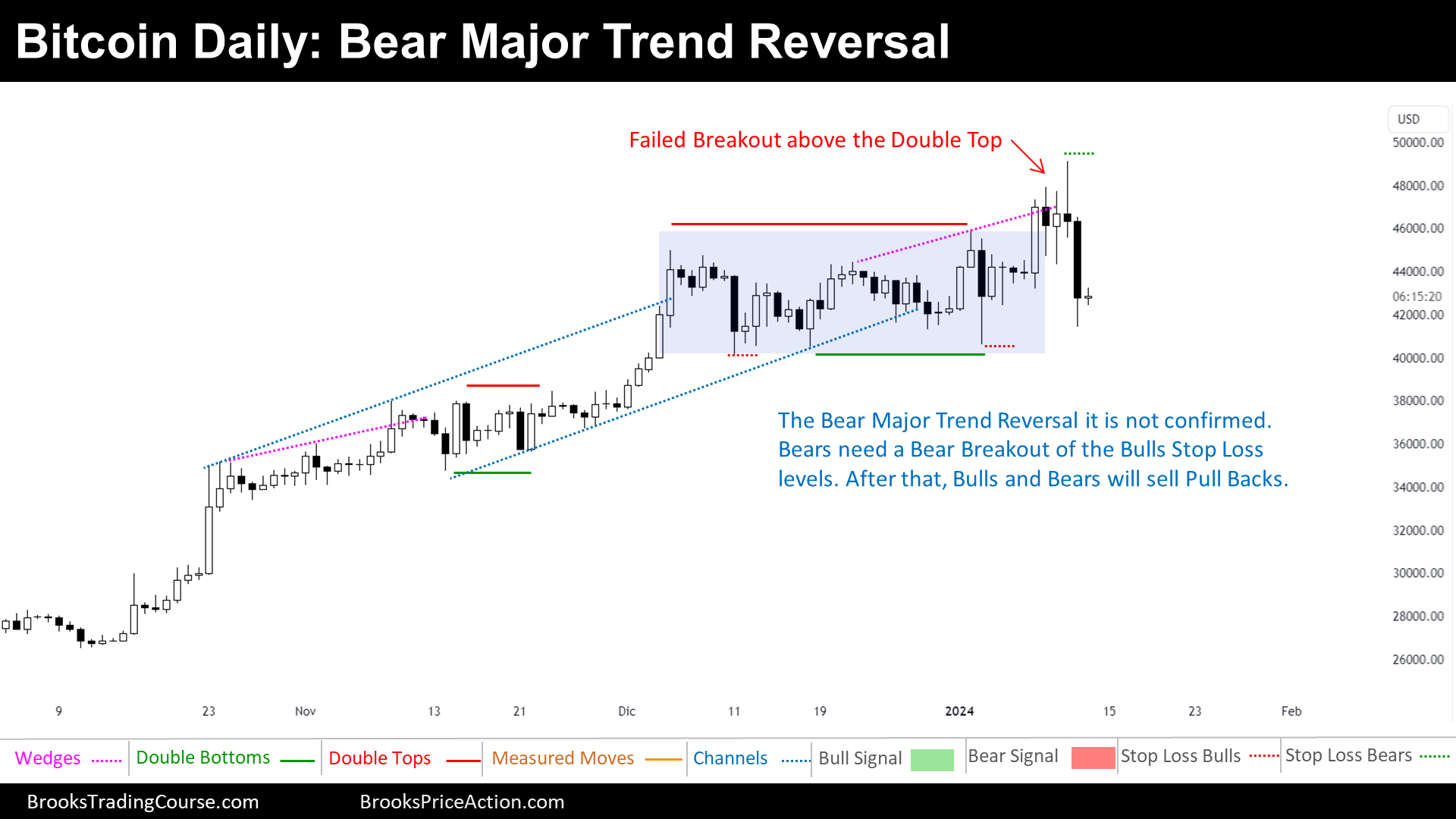

The Daily chart of Bitcoin

Following a complete Bull market cycle, the cryptocurrency embarked on a Trading Range phase. Within this range, traders identified support at the lower boundary and resistance at this week’s high, which it is also the 2024 high.

The ongoing market cycle bears the resemblance of a Trading Range, but there’s a palpable shift in sentiment, indications of a potential Bear Breakout and the initiation of a Bear Major Trend Reversal. Traders are left pondering whether this marks the inception of a Spike and Channel Bear Trend.

Despite the narrative, the Breakout is yet to be confirmed. Clarity will emerge if the Bears do a Bear Breakout below the Trading Range Low, where Bulls have strategically placed their Stop Losses. Until this confirmation, traders should brace for continued Trading Range dynamics. Because of the resistance on a Higher Time Frame, Bulls hesitate to buy, even amidst the possibility of another test of the 2022 High.

A speculative strategy emerges as Bears contemplate selling during a potential attempt at a new high, for example, a 50% pullback of the current Bear Leg. While a low probability sell, its compelling Risk-Reward potential makes it an enticing prospect, especially considering potential weekly targets.

Your insights and perspectives are invaluable to our community. We invite you to share your thoughts in the comments below. What are your predictions for the upcoming market movements? Your engagement enriches our collective understanding, fostering a vibrant exchange of ideas. Don’t forget to share the content if you enjoyed. Good luck and good Trading!

Josep Capo

Market analysis reports archive

You can access all the weekend reports on the Market Analysis page.

Is this an extended cup and handle patter with the double top being the May 22 high and Jan. 24 high? Perhaps a bear leg down is the handle?

Nice analysis. You nailed the 50k resistance and now in a bear leg.

Hola Erik!

Thank you for your comment! I appreciate your acknowledgment of the analysis. Predicting market movements can be challenging, and while another push up towards the 2022 high was spot-on, it’s important to stay vigilant as market conditions can change rapidly.

If you have any further insights or thoughts on the current bearish trend or potential future developments, feel free to share them. Let’s keep the conversation going!

Wishing you a lovely trading week ahead!

Josep

Josep- thank you for your analysis. I wonder if the market pricing in the ETF approval coinciding with the exhaustion event to the 2022 high has neared the completion of this accumulation bull channel. A bear leg down in distribution to restart the cycle at lower prices so strong hands can take advantage of the developing ETF effect on the market seems to make sense.

Hola Elijah,

Thank you for your thoughtful comments and engagement with the daily and weekly reports.

Absolutely. I like to think more of this as the nature. The nature of the markets. I think that if there are no buyers willing to pay more than what it costs (buy at the market orders), the price can’t go up; it is difficult to find buyers if the price it is above the midpoint of a Trading Range (2021-2024 price range). Then the market has to match market orders with limit orders, and if there are not market orders at the current price or above, the only limit orders that can be filled are resting rest below the current price: The nature, the gravity, will push the price downwards. And a good area to find many limit orders it is, for example, a prior area of agreement, a prior fair price, which through price action we know that it was the 5-month trading range of 2023, that it is also below the 50% retracement of the 2021-2024 price range. This how I think of it.

Now, let’s try to connect these dots with your narrative.

After a Bull Breakout, always comes either:

– A pullback

– A reversal

I suppose that this is just a pullback because the Bitcoin adoption has been growing historically, and the fact that an ETF will allow more participants to join, I think that it is a clear indication that the Bitcoin has more room to keep growing.

Therefore, I believe that this is a pullback, that the price will find support at the Major Higher Low, or even higher, and then expand again towards $65000.

I appreciate your contribution to the ongoing discussion. Looking forward to further exchanges of ideas.

Best regards,

Josep

Your description of market orders matching with limit orders when the trend has exhausted is interesting. Is there literature on understanding when this is happening and how to identify it? Or are you assuming because the market doesn’t move up that the only limit orders are below? Are there signs to watch out for that limit orders/market orders are drying up?