Market Overview: Bitcoin Futures

Bitcoin at June 2021 low. This week, the price increased by +2.86% of its value. There were trapped bulls at the June 2021 low who finally got their opportunity to exit their trade. A bear leg should follow.

Bitcoin futures

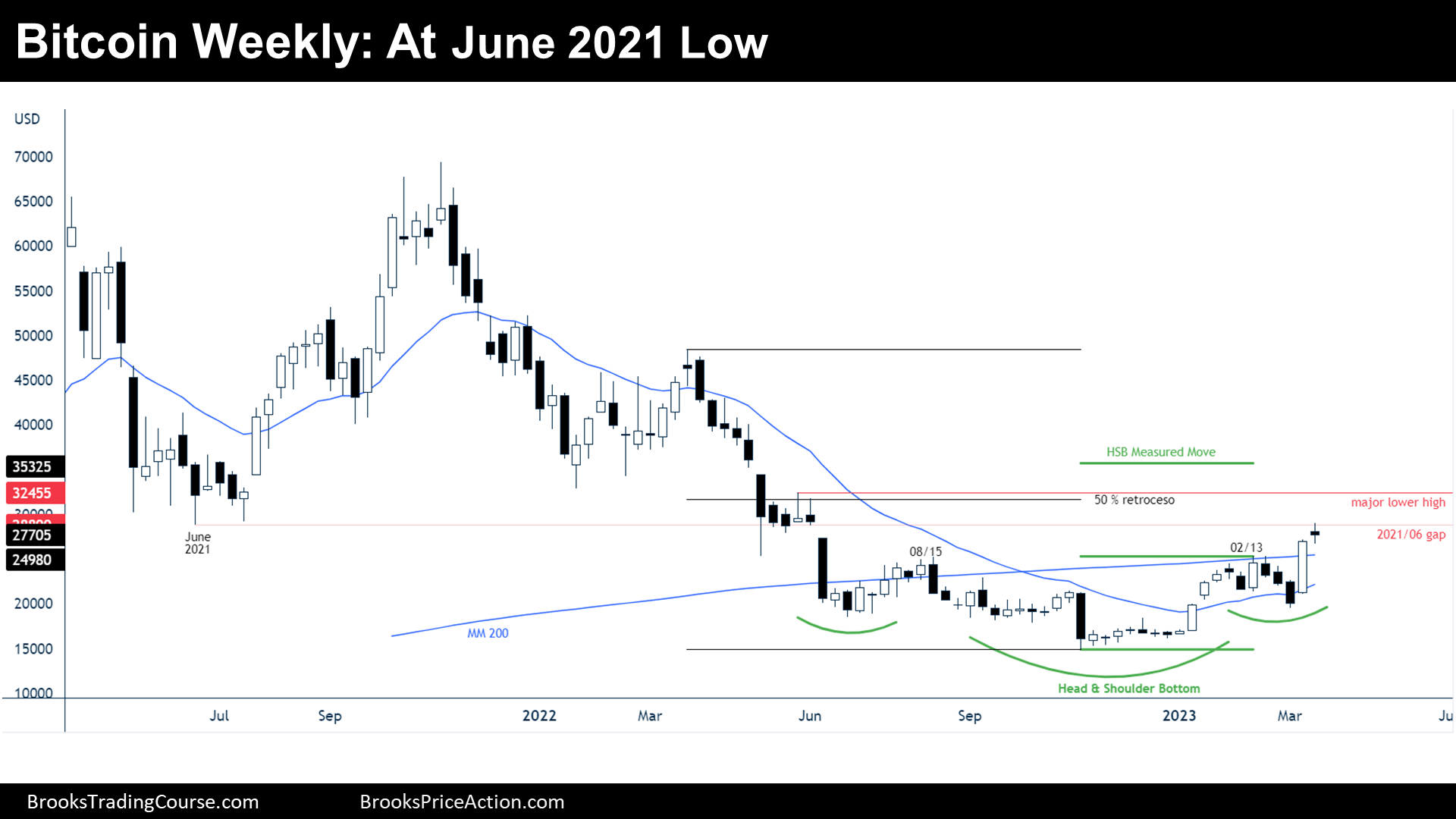

The Weekly chart of Bitcoin futures

Analysis

- This week’s Bitcoin candlestick is a bear doji. The bear doji is not a good follow-through bar for the Head and Shoulders Bottom (HSB) breakout of last week.

- During the last week, we have said that the odds favored sideways to up trading, at least up to the June 2021 low, and this is what happened.

- As we have been repeating since June 2022 Bitcoin reports, there were probably trapped bulls at the June 2021 Low. The reason is that the June 2021 low, at that point, was the low of a trading range, a trading range coming after a bull trend; hence, pretty decent limit order buy.

- Those bulls did not have the opportunity to exit, since their targets would be, at a minimum, between a $5000 or $10000 up move.

- After the bear breakout of the level, the price was never revisited until now.

- Finally, the trapped bulls could get out of their trade.

- The general context is a trading range, nor a bear trend or a bull trend. That means that traders want to buy low and sell high.

- If traders intend to buy low and sell high, bulls won’t buy at resistances, but bears will sell. If bulls are selling here (trapped bulls) and bears are selling, the most likely outcome is a bear move.

- Nowadays, the price is either:

- Bulls want a measured move up from a HSB pattern. At a minimum, they want to get to the major lower high because that will limit the downside risk. Nowadays, the trapped bulls are gone; hence, if there is a bear leg failing to get below the 2022 low, they will bet for a higher low major trend reversal, and their odds of a major trend reversal will be much greater than today.

- Bears want a strong bear leg starting from here. Their goal is to get below the 2022 low.

- Since the price is stalling at resistances, traders expect a bear leg starting during the following month.

Trading

- Bulls: They will have better odds if they wait for a bull signal bar below the 20-week Exponential Moving Average.

- Bears: The price it is at a sell zone, some sold the June 2021 low, others will sell the 50% retracement, and others will wait to sell a bear bar closing on its low. If the price do not get to the major lower high, they might hold their trades expecting a new low of the bear trend, but if it gets to the major lower high, they will probably take quick profits.

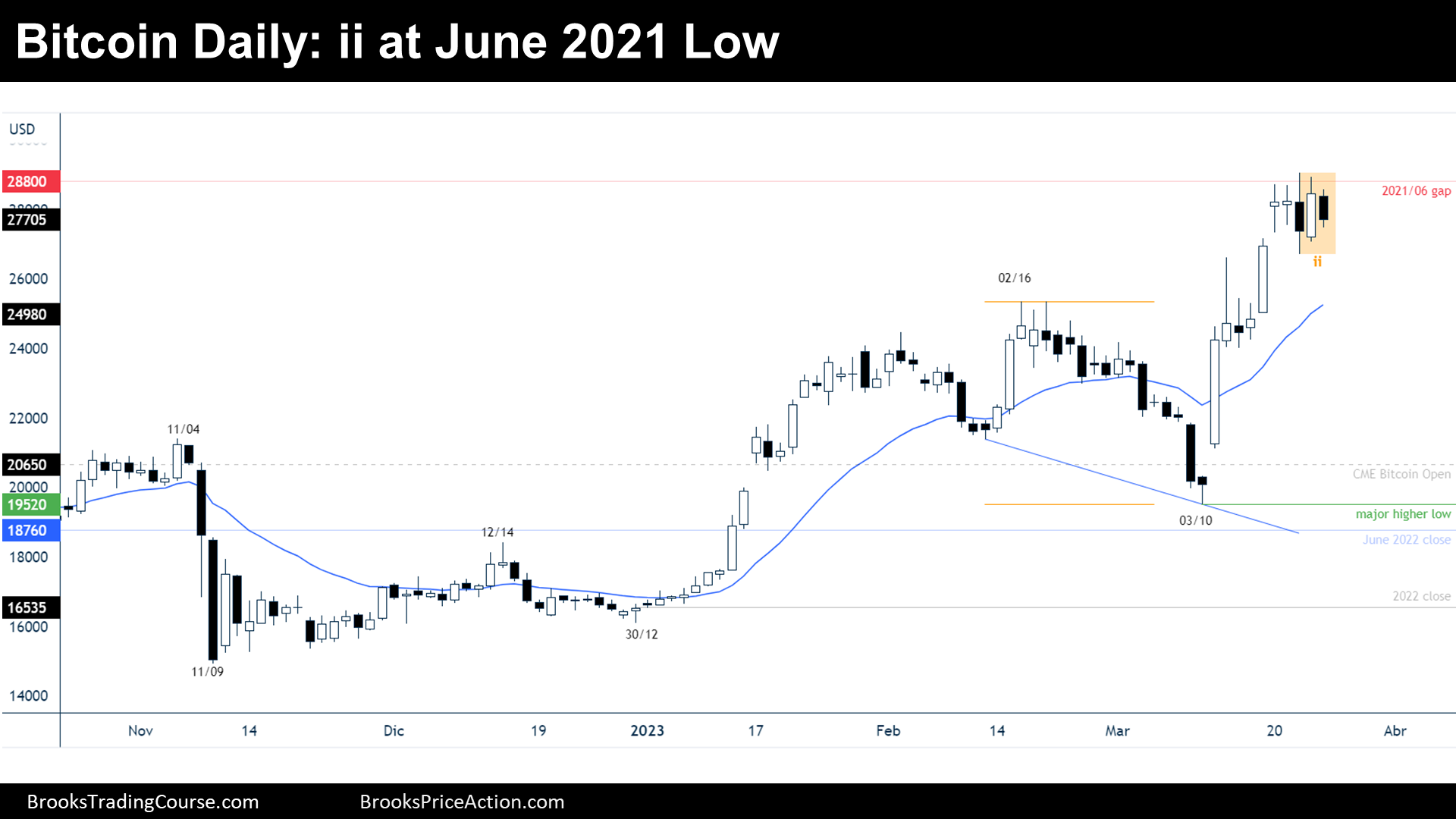

The Daily chart of Bitcoin futures

Analysis

- During the week, after gapping up, the price reached the June 2021 low while trading sideways. At the end of the week, the price formed an ii pattern.

- The price was within a bull breakout market cycle that broke above an expanding triangle.

- But within the bull breakout there are many dojis and big bars with tails, which are signs of a trading range price action instead of trending price action.

- The price created a reversal pattern at major resistances (ii pattern).

- Nowadays, the price is either:

- Bulls: They think that the context is a broad bull channel, and that they will get to a measured move up based upon the 2/16 high and 3/10 low.

- Bears: They think that the context is a trading range, and that a bear leg is underway since the price creating reversal patterns at major resistances.

- The general context is more likely a trading range than a broad bull channel, since the price is facing major resistances. Therefore, odds favor sideways to down trading during the next week.

Trading

- Bulls: They want to buy lower, at least a 50% lower from the highs.

- Bears: They can sell reasonable below the ii pattern. Their stop loss is above the ii pattern, and their target should be at least twice their risk, since the probability of success of this trade is in theory 50%. Another bear target is 25000 big round number or the major higher low.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.