Market Overview: Bitcoin Futures

Bitcoin futures started trading 2022 at a price of $47120; By the end of the year, it closed at $16535: the Bitcoin 2022 Futures price dropped almost 65% during the past year. Bears were strong during the first half of 2022; during the second half, their strength diminished by trading sideways. $16535 becomes a paramount important level for the upcoming year.

Bitcoin futures

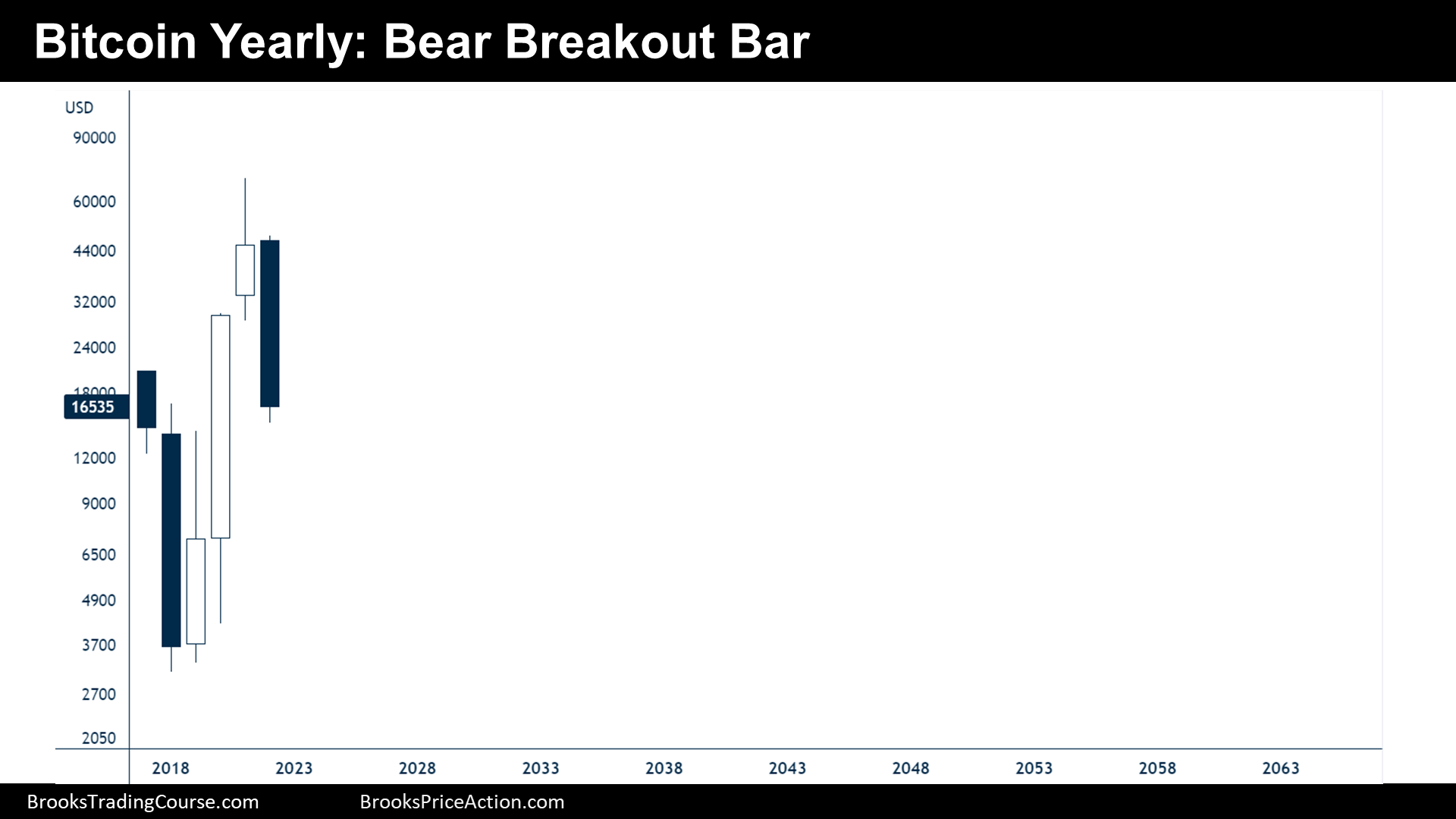

The Yearly log chart of Bitcoin futures

Analysis

- 2022’s candlestick is a bear breakout bar closing around its low.

- 2020 broke above 2017 high, creating a bull breakout.

- Nowadays, the price is either:

- Bull case: Testing the prior breakout point.

- Bear case: The bull breakout is failing.

- Bulls want to hold above the all-time lows; they want a bull bar on 2023. That will mean that the long-term bull thesis remains, that a spike and channel is forming.

- Bears want another bear bar, but more importantly, they intend to get to $3120, the all-time low, which is the price where the bull breakout will technically fail.

- The context favors slightly the bulls because of the prior strong bull breakout, and, at least, another leg sideways to up should be expected during the upcoming years: this could be the most likely outcome, meanwhile bears do not get to $3120.

Trading

- 2022 is a Low 2 bear sell setup, but not specially good for stop order bears since it is too low because the price, at a maximum, it can only get to zero (on spot trading, not futures): the risk is high (around $53000 on the upside), the reward is small ($16535 on the downside). The probability of going to zero is low.

- For the bulls it is not a good stop order signal since it is a bear breakout bar; sellers above are expected. Nevertheless, the risk reward ratio sounds good for the bulls. Their risk is small ($16535 on the downside) and their reward is potentially big, at least up to $69355, the all-time high. The probability is not bad since the bull breakout did not technically fail yet.

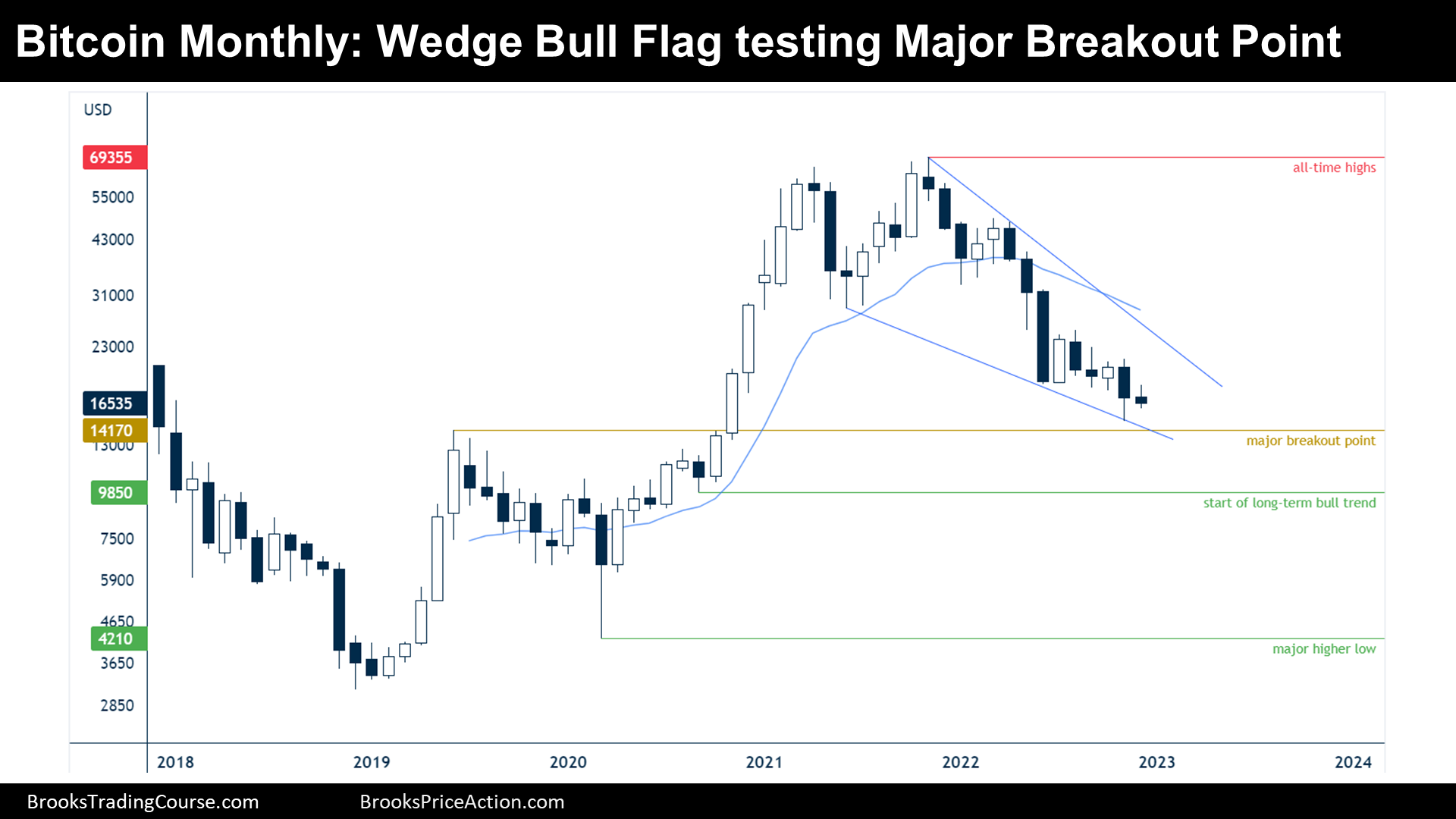

The Monthly log chart of Bitcoin futures

Analysis

- December is a bear inside bar during a bear trend.

- During the past monthly report, I have said that since November closed around its midpoint, an inside bar was expected for December, and this is what happened.

- Nowadays, the price is either:

- Bull case: Pullback as a wedge bull flag within a broad bull channel.

- Bear case: A small pullback bear trend.

- Bulls think that the price will hold above the major breakout point and, more importantly, above the start of the prior major bull breakout. The bears have been strong, and the first reversal up will likely fail.

- Bears believe that the price is within a strong bear breakout; their proof of that is that they managed to keep open gaps during the bear trend. They think that the bear trend will continue all the way down, first until $9850, the start of the bull breakout, and then, down to $4210, the major higher low.

Trading

- December is a bear inside bar, a Low 1 sell setup during a bear trend. It is, apparently, a good sell setup. The problem (not appreciable on the logarithmic chart) is the risk reward ratio: the stop is $32420 higher (major lower high at $48475), and the reward is $11845 lower (major higher low at $4210). Moreover, looking at the left of the chart, there is a strong bull trend; hence, strong supports along the way should be expected. Definitely, for bears it is much better to look to sell a bit higher, at around $30000 or the 20-month exponential moving average.

- Bulls might buy around here based upon their good risk reward ratio, but the context it is not good in the near term (1-5 months) since the first reversal up will probably fail. For the bulls, it is better to wait until a double or wedge bottom emerges after bear gaps begin being closed.

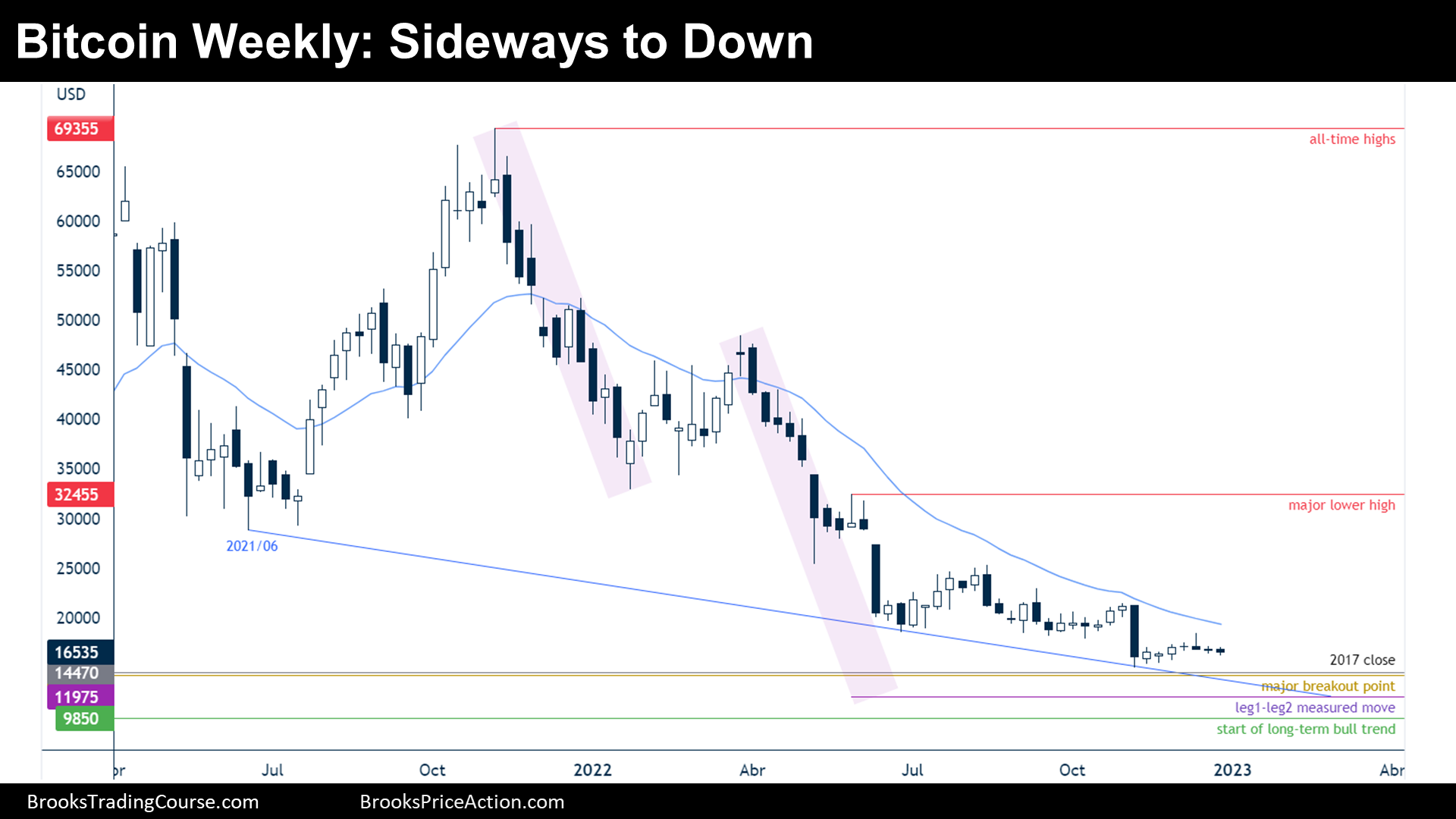

The Weekly chart of Bitcoin futures

Analysis

- Last week’s candlestick has a bear body, but the price closed slightly above its midpoint.

- The price is within a bear channel that weakened during more than 20 bars, by trading sideways to down. Lately, the bars are minimal, which means that the volatility is low.

- Nowadays, the price is either:

- Bull case: Bear final flag setup.

- Bear case: Bear flag and continuation of the bear channel.

- The bear trend has more than 2 legs down, which could mean that the bear trend is exhausted.

- Bears did not achieve all their major targets, the classic leg 1 – leg 2 measured move; but before it gets there, the price has to break down an important support: the major breakout point or 2017 close. Exhausted trends do not tend to break major price levels, but reverse there.

- Some strong bear gaps remain open (for example, between the major lower high and the January 2022 low) and this means that the bulls are not well positioned for a successful bull trend reversal during the first half of 2023; however, the context favors either sideways trading above the prior major breakout point or the 2017 close, or a reversal up from this area.

Trading

- The past few bars are disappointing for both bulls and bears. Traders prefer more price vitality before taking any action, this means bigger bars.

Wishing you all a new year rich with the blessings of love and joy. Let Price Action be your guide and Risk Management your boss!

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.